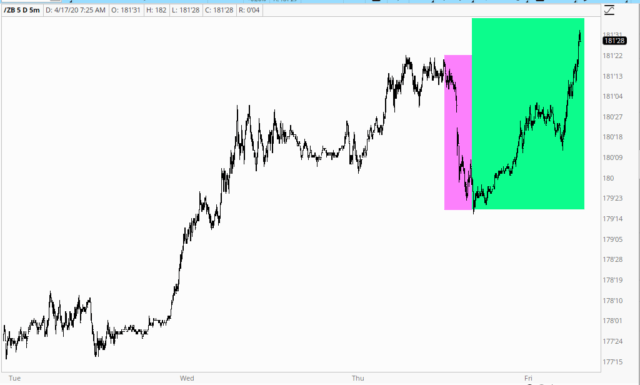

After Thursday afternoon’s love-fest of optimism, equities went exploding higher and bonds got smashed (magenta tinted area, below). Ever since last night, however, bonds have valiantly fought their way back:

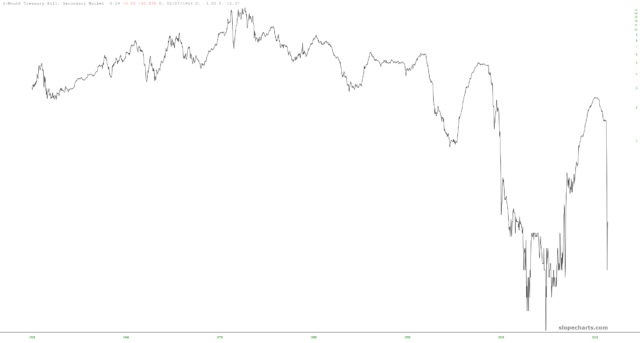

It seems to me that any attempt to knock bonds down will be short-lived. Just about any index-rate related chart shows the same phenomenon, which was a halting, cautious attempt to build a base which, as of last month, which torn to shreds. Just look at this carnage (as always, clicking any chart makes it super-big):

I strongly believe that near-zero, or even negative, interest rates are going to be a feature of our economic landscape for years to come. The ghastly amount of global debt simply won’t support anything else.

While I have your attention, I might as well share a few words about what has transpired since yesterday’s close with respect to my portfolio and my general disposition.

It probably goes without saying that it is terribly distressing to be fairly heavily loaded up with short positions (88 of them!) and 166% committed while facing an absolutely explosive ES and NQ. All one can do is wait for the 16 1/2 hours until the regular market opens up again.

I deliberately avoided looking at the ES and NQ and knew I would probably have a hair-on-fire morning to deal with. My brain was conjuring up all kinds of nightmare scenarios. What if the ES was up 300 points?

I didn’t sleep well at all, and I finally allowed myself out of bed at 5 a.m. Taking a deep breath, I fired up the iPad to see where things were. The ES was up about 75. I never thought I’d be so happy to see the ES up “only” 75 points.

In any event, it was still bad. I have very little patience with any losing positions these days, so I beat a hasty retreat from 88 positions down to 53, which, believe me, takes some doing. There are decided advantages to having this “style” of portfolio, but it is extremely unwieldy at times like this.

In any case, I retreated back to a more comfortable level. I’ve got 20 new shorts that I might enter, waiting in the wings, but I am continuing to monitor this market closely. I still contend that this entire ridiculous run-up has been counter-trend, but Jesus Christ, it’s annoying beyond belief.