Unfortunately the week has become dominated by the news relating to the possible imminent invasion of Ukraine by Russia. At the time of writing there has been no invasion, and the consensus view this morning seems to be that there is no credible sign that Russia is backing down yet either. We’ll see, but news could move this tape a long way in either direction.

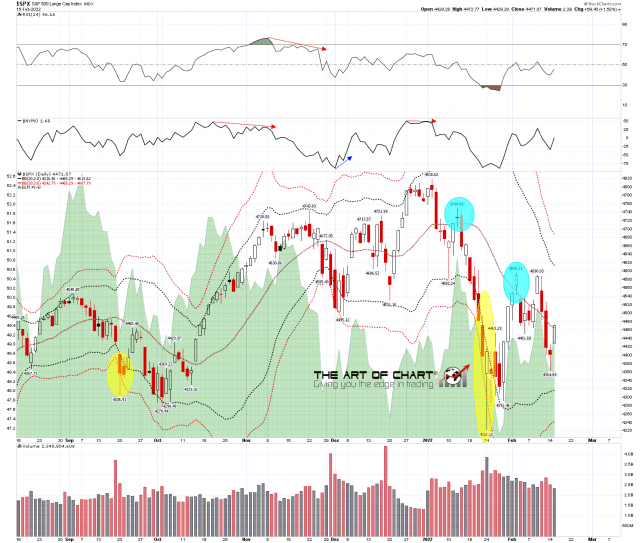

At the close yesterday SPX closed slightly back over the daily middle band, currently at 4465. Only a slight break, more of a close on the band than over it, but a follow through today would open a possible test of the monthly pivot at 4519.

SPX daily BBs chart:

On a break back over the monthly pivot, which only seems likely on news of peace breaking out in Ukraine, then we could see a third test of main resistance at the weekly middle band, currently at 4574.

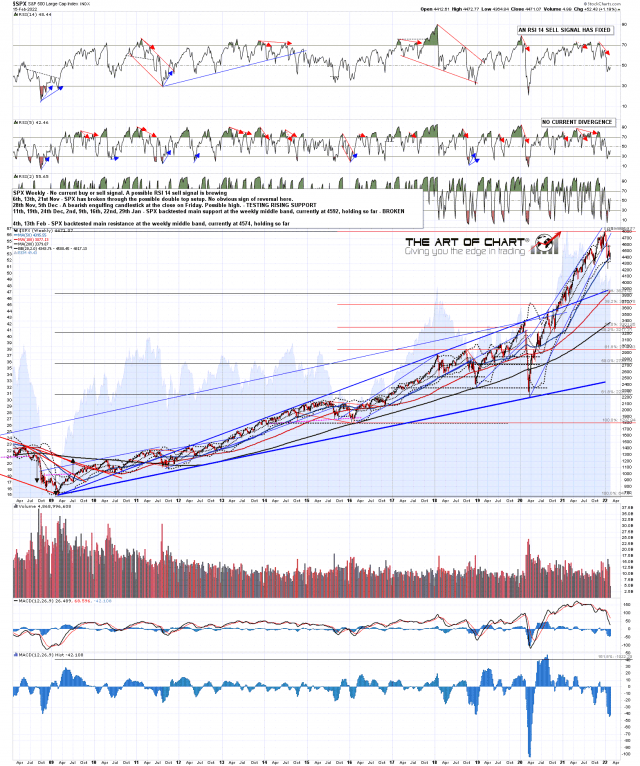

SPX weekly chart:

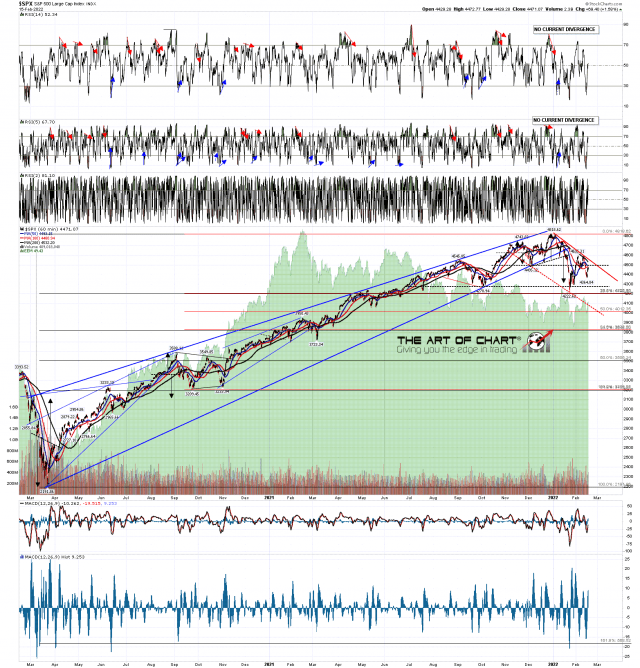

In the short term there is resistance on the SPX hourly chart at the 50 hour MA, currently at 4493, and declining resistance from the high, currently in the 4560 area. On the downside trendline support is currently in the 4080 area.

SPX 60min chart:

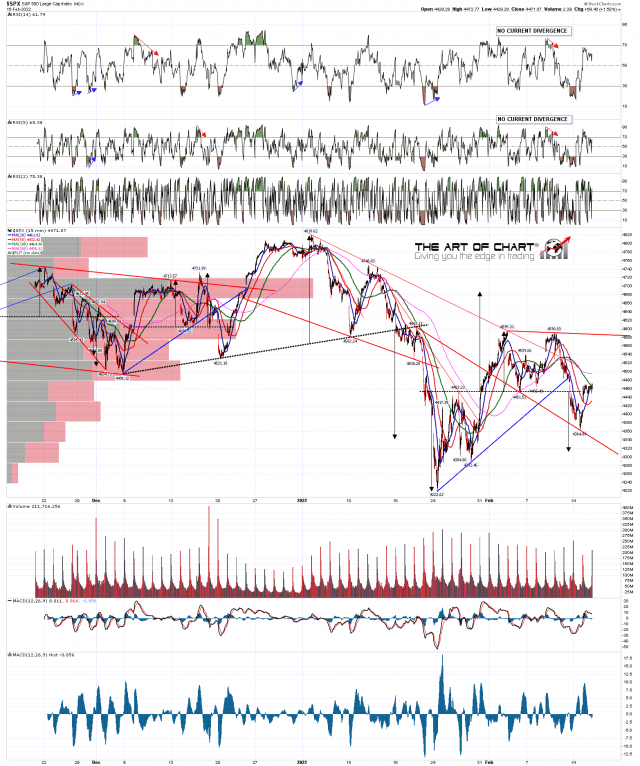

On the 15min chart the double top setup there broke down with a target in the 4310 area, and on a decent quality reversal pattern like this that target will either be reached, or SPX will reject back up into the prior high at 4595. There is a short term high quality support trendline on SPX from the low this week and that is suggesting that on the next high a matching resistance trendline for a pattern will be established. If SPX heads straight up then that trendline may already be there, as bull flag megaphone resistance, currently in the 4587 area.

SPX 15min chart:

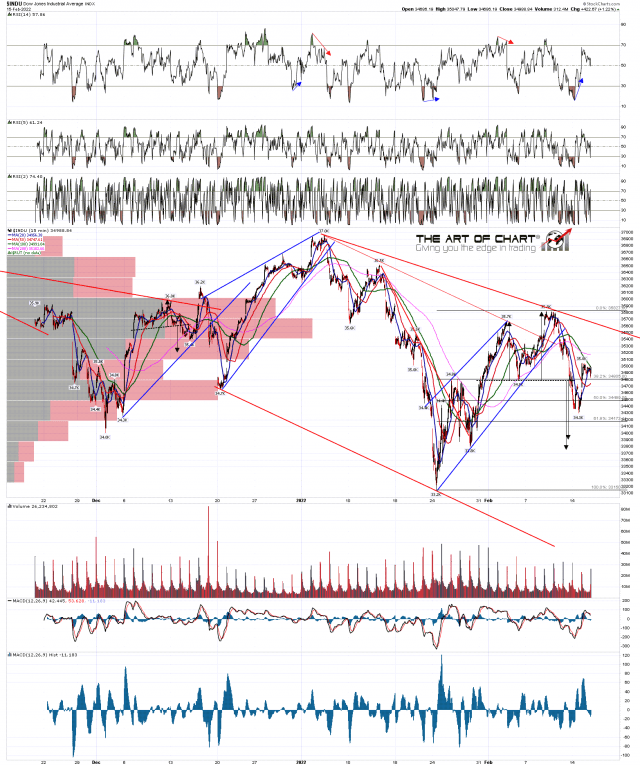

The double top setup on Dow also broke down with alternate targets in the 33750 and 33900 areas. As with SPX, that target area should either be reached or Dow should reject back up into the prior high at 35.8k.

INDU 15min chart:

There is still a lot of news risk this week and whether Russia invades or not the news may deliver a large move in either direction on equity indices, as well as delivering further large moves in currency, bond and energy markets. This is still very much a week to be wary.

We are doing a free public webinar at theartofchart.net an hour after the RTH close tomorrow on FAANG Stocks and Key Sector ETFs. If you’d like to attend you can register for that here or on our February Free Webinars page.

Our high end options service Paragon Options started the year strong with a $47,000 profit trading ES in January. We are looking at taking on up to ten new subscribers this month and if you’d like to sign up for a free trial you can do that here.