The mornings are always the toughest.

I’ve got no problem standing here, waiting for the seconds to tick down to some big event, like an FOMC announcement. I’ve got no worries managing these gazillions of positions hour by hour. But, waking up at 4 in the morning, looking into the darkness, I have no idea what I’m going to face. Especially these days. Is there peace? War? Has a nuclear bomb exploded? What’s going to face me when I flick on that very first screen and see what the day is going to be like?

That, then, is the toughest. But by 5 a.m., I tell myself, well, bucko, time to face the music. Get yer ass outta bed, get downstairs, and flick that screen on.

Before I’ve done so, I’ve already played out the script in my head. If I see THIS, then I will do THAT. And if I instead see THAT, then I will do THIS. I don’t want to be greeted with a given fact and have no idea what to do. I want a plan.

For those of you who watched my videos last night, you knew what my endlessly-cited “ideal scenario” was. Since I have covered so many shorts, gone long QQQ calls, and gone short (in a very big way) XOP and XLE, my “ideal scenario” was plain as could be:

- Strength in equities;

- For gold to “back off” to show fear was subsiding;

- Weakness in oil, to benefit my huge XLE and XOP puts;

- And, at a certain point, to exhaust the bounce, giving me an opportunity to dump my QQQ calls at a big profit and aggressively short again like a maniac.

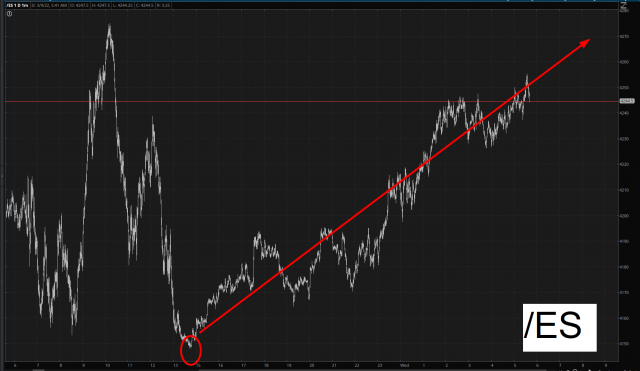

Well………….I continue to feel very “in synch” with this market in the year 2022, because what I am witnessing right now is…………strength in equities:

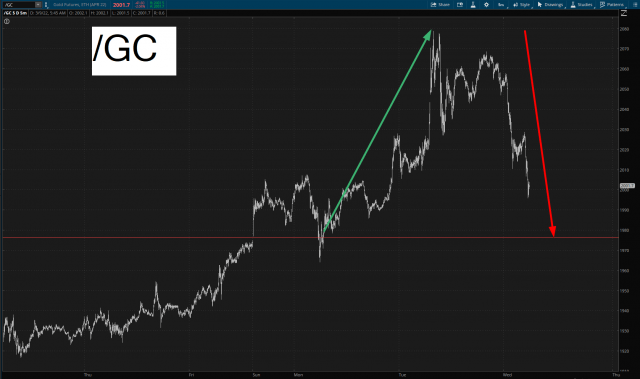

Gold “backing off“:

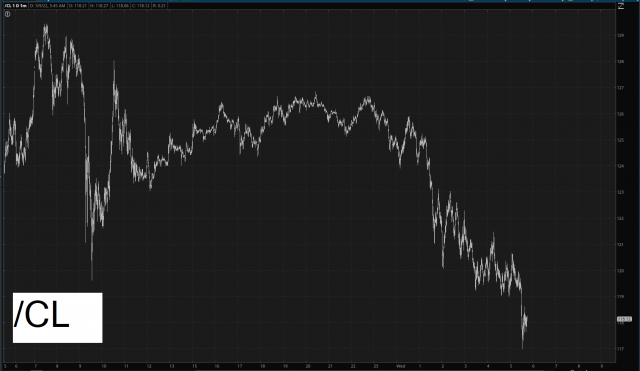

Crude oil (thank you, sweet baby Jesus) falling for the first time since the Eisenhower administration:

Honestly, this is DYNAMITE. I couldn’t ask for a better scenario. Why am I so blessed? Clean living? A full head of lustrous hair? Being nice to animals? Who knows.

The funny thing is that most of my bearish positions will obviously have some damage, and I am SO all right with that. As I mentioned, I have HALF as many bearish positions as before. The two huge ones, though, XOP and XLE, entered yesterday, should be dandy.

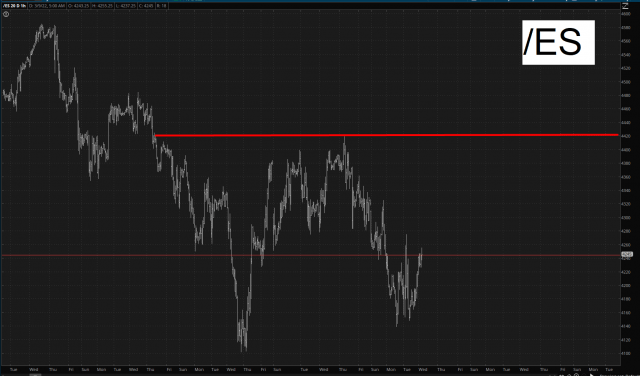

All right, Tim, fine, so how high would you like this to bounce? Well, if you have cocktails with the market gods, and they ask you that, please inform them I’d like the /ES to get back up to this level, if you don’t mind:

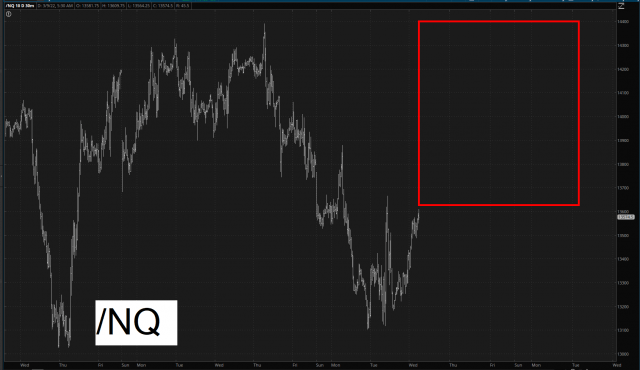

And, more germane to my April 22nd call options on the QQQ, this is what I’d like the /NQ to traverse.

One other remark about those QQQ calls: they are, for me, rather short-dated. In other words, they have a mere 44 days until expiration, which for me is aggressive (I am more comfortable with options that expire three or four months out, if not more). But I have no intention of hanging on to these things for months, so I’m not going to pay for all that time premium.

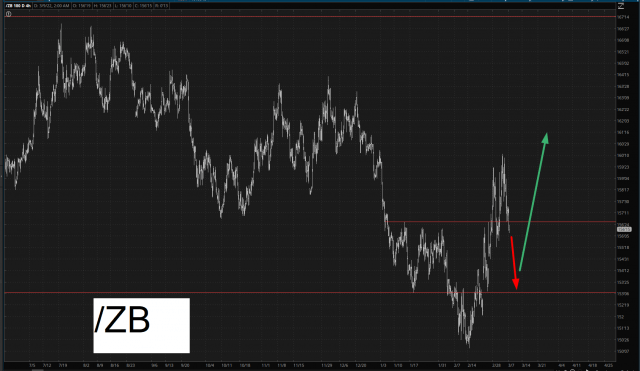

Let me double down and say something about a market which doesn’t get as much attention here – – bonds. I’d like to offer to you the prediction that bonds will weak to the zone I’ve pointed out, after which they strengthen dramatically.

And that, my friends, is the lay of the land.

Now we wait.