Preface from Tim: Beloved Sloper Buccaneer was kind enough to answer my “call for content” during my most desperate hour (that is, since I’m traveling) and submitted a huge post which I’ve broken into several parts, not just because it’s so danged big, but also to stretch out the content for my own purposes. Thank you, Bucc! Part 1 is here and Part 2 can be read here.

The most important aspect of Theta to remember is that it assumes IV & price movement are held constant. Markets move every second, so it is unrealistic to expect them to be frozen. We can’t look at our options and expect the value to decrease by Theta every single day. While Theta will come out of the option, price movement & IV will change the value as well. As long as we’re on the right side of the coin (positive Theta), we can rest assured that our option’s extrinsic value will get lower and lower as we reach expiration, which is one of the keys to success for an option seller.

Selling 1 DTE SPX Put Credit Spreads Options

Opening

- Check on the SPX Options Chain the upcoming 3 expiration cycles IV% to identify the trend. Decreasing bullish, increasing bearish.

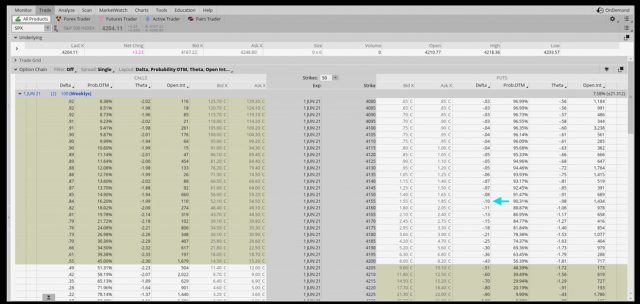

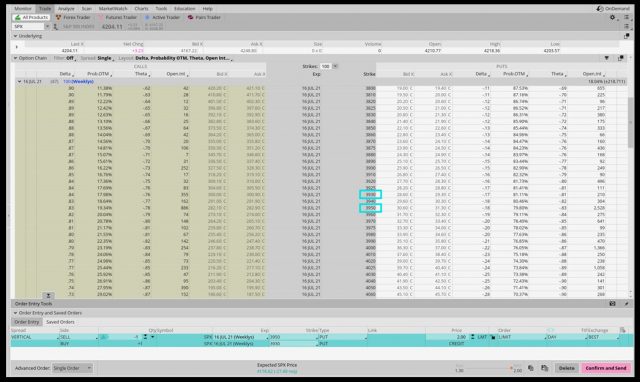

Figure 9: TOS SPX Options Chain with arrow at the IV%.

- Open the 1 DTE and look at the Short strike Puts with 90% probability of being OTM minimum / below 10 Delta (around 1.5 SD).

Figure 10: TOS SPX Options Chain showing at 10 Delta range.

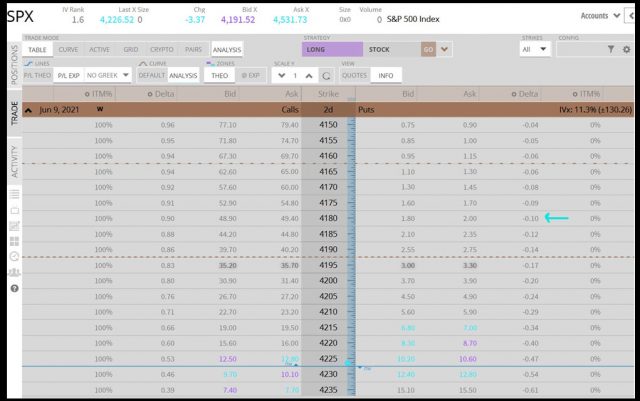

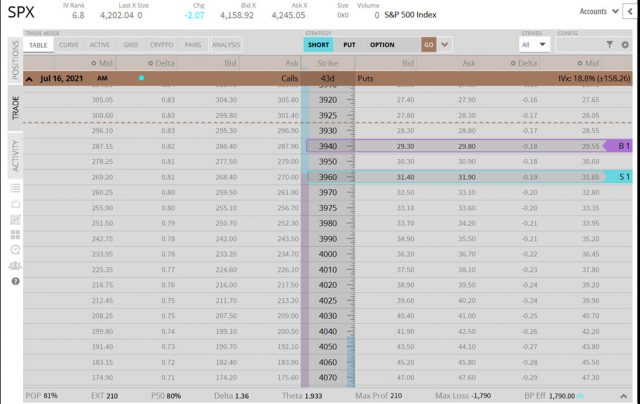

Figure 11: TW SPX Options Chain showing at 10 Delta range.

- When SPX price dips a minimum of 10 pts Sell to Open (STO) SPXw (weekly contract) 1 DTE 20 pts wide Put Vertical for .50 minimum. Never sell more than 10% Buying Power (BP or the maximum amount of capital in your account available to make trades including cash & margin).

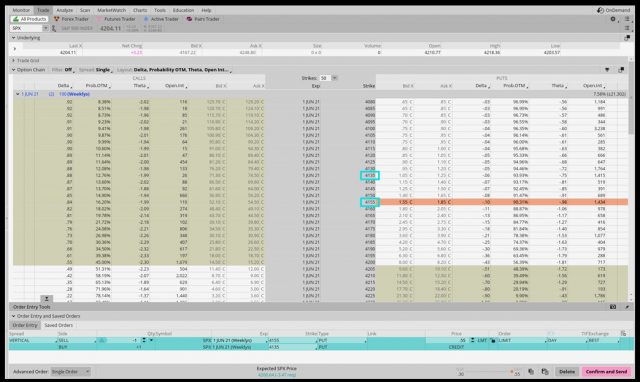

Figure 12: TOS SPX Options Chain with .50 Put Vertical.

Figure 13: TW SPX Options Chain with .50 Put Vertical.

Management

1. When trade executes, immediately set up a Buy to Close (BTC) GTC (Good Till Cancel) order to close the spread (buyback) for .10.

2. Monitor EM.

3. If EM touches short strike, adjust price to close the tested spread. On extreme volatility, EM can touch and pierce your Short Put Strike, but you usually wait until it settles. If you are threatened or ITM overnight, buy back around 5X credit received (at a manageable loss).

4. If trade closes on the same day, look to re-establish round 2 on the next dip. Be careful to BTC round 2 next day (0 DTE) if your margin account (<25K USD) is subject to Pattern Day Trader (PDT) rule. Round 3 on same 1 DTE contract is common on highly volatile days.

5. It is beneficial to ladder in your Buying Power across a few spreads of 2% BP each (up to 10% BP in total). Sometimes you need to sell 30 pts wide spreads in order to get filled at .50 (1 DTE) or 2.00 (45 DTE), so you have to manage your BP accordingly.

6. If trades hold overnight and the market moves in your direction (up) adjust the GTC price of the spread to .05. No point to let the trade expire. Always buy back your Monthlies before the Closing Bell as they expire AM.

Baseline plan

Normal to up market: 10% BP allocated to 1 DTE trades.

If market drops 1% or more:

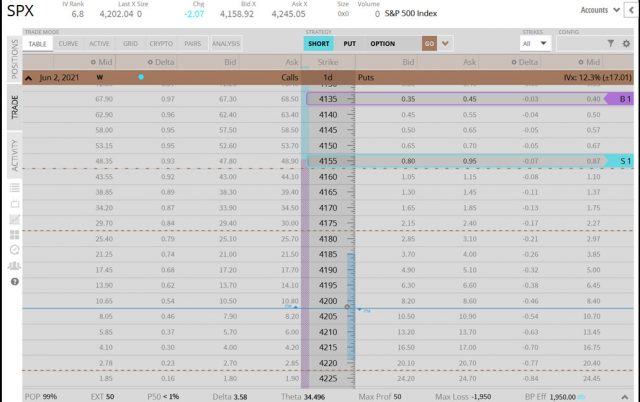

10% BP for 1 DTE trades + 10% BP in monthly expiration cycle closest to 45 DTE: Sell to Open (STO) SPXm (monthly contract) 45 DTE 20 pts wide Put Vertical for 2.00 minimum and BTC GTC order at 1.00 (50% of profit).

Figure 14: TOS SPXm Options Chain with 2.00 Put Vertical.

Figure 15: TW SPX Options Chain with 2.00 Put Vertical.

Defensive Plan

If 1 DTE spreads are closed due to an Expected Move touch of the short strike, increase BP allocation to 30% in the 45 DTE SPXm window or next SPX 1 DTE (weekly monthly quarterly). Timing is important to capture the increased Premium pricing due to volatility.

10% 1 DTE + 10% 45 DTE + 30% max BP for repair trades 45 DTE and 1 DTE defensive trades.

If defensive 45 DTE (30% BP) threatened again (happened only in 2022 since 2013) we roll next 45 DTE SPXm same BP.

Trading small, trading often.

Random important takeaways:

You MUST understand what you are doing (I really feel sorry for those who followed my trades and didn’t make it), if you don’t, better stop trading because it’s all about managing risks. You need to be disciplined and mechanical.

You really need to understand and experience it to fully see how powerful this method is.

It is not just “buying the dip”. We sell Options Puts in weakness. With the increase of volatility, the Options strikes expand along and we can choose out of reach strikes FOTM (Far Out Of The Money).

Options are agnostic, so you can win in an uptrend, downtrend or flat market.

Avoid 0 DTE plays (monthlies included). Too much risk.

I don’t believe in luck, so I’m not wishing you good luck. Probabilities rule.

I believe in numbers and this method of trading is MINDBLOWING!

I haven’t discovered something; it’s just applying maths & probas to derivatives.

I want first to thank my mentor Ed. THORP.

Thanks to all Yahoo!, Tastytrade and Slope Of Hope followers who were respectful.

Grand Merci à Tim Knight, the Great Bear!