All right, the big data point is behind us! Before the CPI was released, there were all kinds of speculative, often contradictory, stories about the CPI and what it would mean. ZH even had two adjacent articles which said the exact opposite thing.

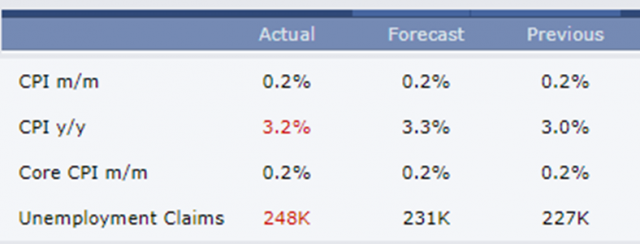

Personally I think all the if-this-than-that stuff they crank out each month is silly. I mean, what’s the point of it all? Anyway, the real data is in front of us now (at least inasmuch as we can call this government-generated data “real”) and it came in nice and soft, just like the bulls like it. Of course, if you actually believe year-over-year inflation is 3.2%, then I’ve got an annual Jim Cramer Picks subscription to sell you.

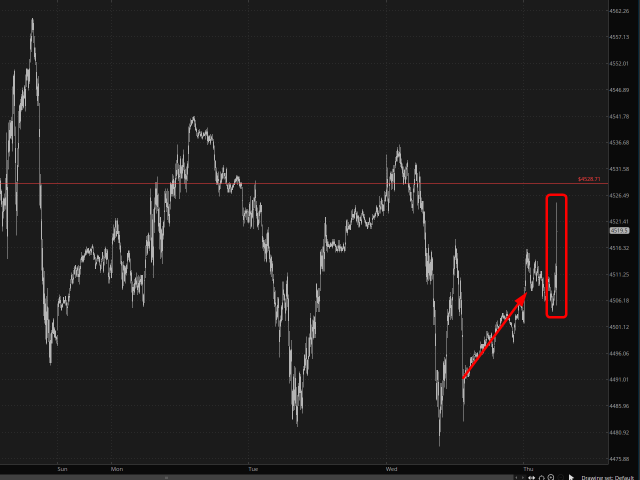

The effect was immediate. Equities spiked higher. Please note as I am typing these words, the charts are already wildly out of date, because things are moving quickly. Shortly after the CPI came out, the /ES was up about 35 points. As I am typing these words, it is up HALF that much. So it sure is odd how a static data point is getting “digested” in fresh ways mere minutes after the release.

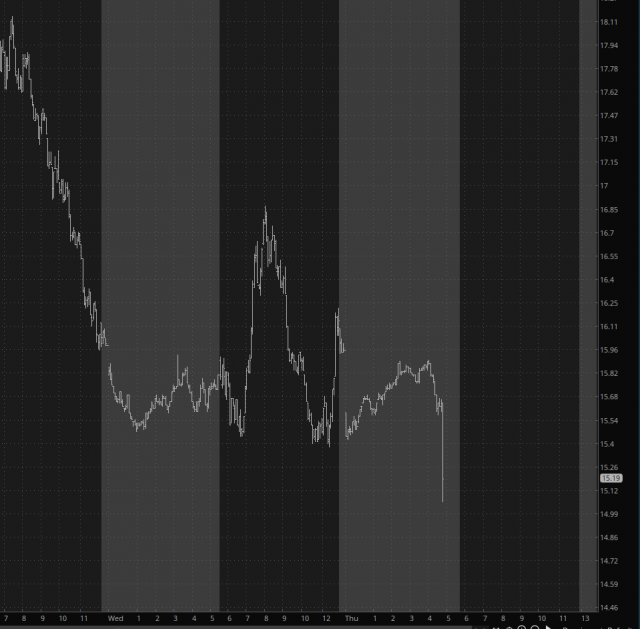

Volatility, naturally, collapsed, since a big uncertainty was removed.

And gold, for a change, zipped higher on the news. I used to think inflation was good for gold, but these days, I guess what the US dollar does is more important.

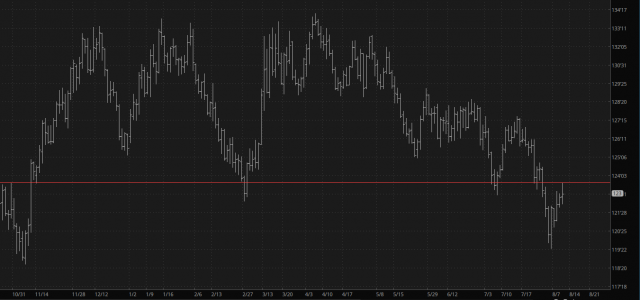

One pattern I find particularly intriguing is bonds 9/ZB) which has a tremendous – – I’m talkin ‘huge! – – right triangle top. Simply stated, we could be seeing MUCH higher interest rates a year from now. Wouldn’t THAT be something for Powell to contend with, eh? But at least it isn’t an important election year or anything.