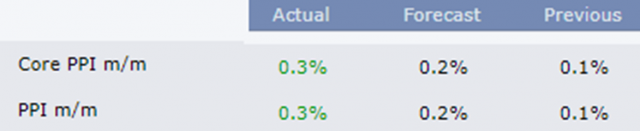

The latest comically-watered-down inflation numbers came out, and in a rare instance of letting a tiny bit of truth slip out, the government stated that the producer price index was a full 50% higher than forecast. As I’ve mentioned endlessly, the inflation rate isn’t 3% a year. It’s 3% per MONTH. But somehow people just don’t want to admit it.

The reaction, thus far, has been deliciously negative for equities. Yesterday’s reaction to the ice-cold CPI (which utterly threw me off my game) is emphasized on the chart below with the red rectangle. It lurched up and down violently a few times before finally deciding to get all Jim-Cramer-ish and stupidly rally. Of course, that was the end of that, and it has been eroding harshly ever since. I will try not to mention the profits I surrendered in my SPY and QQQ puts more than 500 times today.

On the right side of the chart, you can see that the PPI reaction didn’t pretend to be anything but bearish. I’ll say again, Jerome Powell WILL fail (he already has). Inflation is going to RAGE, and interest rates are going to ROCKET. There is nothing but darkness ahead, but people are too fixated on nitwits like Cathie Wood, since it provides them some measure of misguided maternal solace.

The most important development, which I think everyone except Slope is ignoring, is that bonds are setting up for an absolute calamity. The chart of the /ZB just looks better by the day.

As for my own portfolio:

- I am 100% invested (zero buying power) with an average of 191 days until expiration.

- I am in three ETFs (XLU, XME ,XRT) and eleven equity positions, all by way of puts.

- Selling my SPY and QQQ puts yesterday was an act of stupidity rarely matched.