In a superb example of bad timing, I have some personal commitments to address during the first hour of the trading day, which of course includes the Powell speech. So God help me! In advance of that, I am punching out this post about an hour before the opening bell, with a few musings about some important ETFs.

The Dow Industrials have (just barely) broken their trendline.

Small caps are very close to powerful support (the Fib line)

High yield bonds are breaking down.

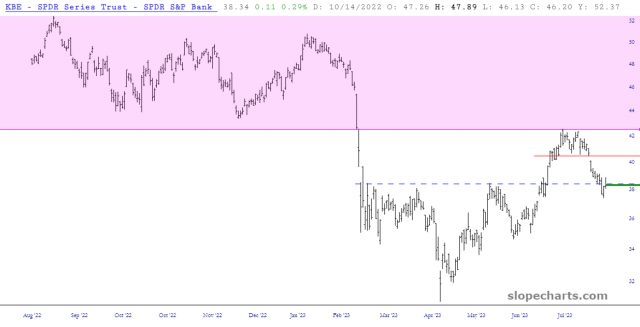

The banks are slipping below key support.

The S&P 100 ETF is close to finishing a nice little topping pattern, which could set it up for a trip to that supporting trendline far below.

And, perhaps most importantly (and quite germane for this morning) the bonds look extremely precarious.

I am pretty much “fully loaded’ but have strictly adhered to my regimen of puts that expire AFTER the year 2023. So I’m going to try to keep my wits about me, since I have an ungodly amount of time to be right.