I hope everyone had a great holiday. I’ve had an enjoyable time at home with my three (adult) children. We’re not religious, but it is always a good time to see and enjoy family.

One slightly strange thing to the Brit eye about Christmas is that over here and in much of Europe the day after Christmas is a significant holiday too, always a Bank Holiday and called Boxing Day here. The odd thing is that Boxing Day doesn’t exist in the US and is an immediate return to trading the day after Christmas Day. That kind of works for me though, as I enjoy my work, and the days between Christmas and New Year are a good time to prepare for what is often a very interesting January. In my view the odds favor seeing an interesting January this time.

I haven’t been writing much lately. A bit of writer’s block, and for a specialist in reversals the last few weeks have been fairly uninteresting. However things are starting to look very interesting now as we close out 2023, and the prospects for a volatile bi-directional start to 2024 look very promising.

Hopefully some of you did catch my warning on the social media platform formerly known as Twitter that a significant low was likely close and might start an upswing that might last the rest of the year. We’ve seen a number of those significant lows in Octobers over the years and that certainly delivered this time.

Twitter low warning from Oct 26th:

What I was thinking might happen from the low into the end of 2023 is something I’ve been mentioning every so often as a possibility since the low in 2022, from a near perfect 50% retracement of the low move up from the low in 2020. That 50% retracement might of course have been a bullish retracement setting up a new bull move into a series of new all time highs or, a retest of the all time high might instead be setting up a very large double top that might deliver a retest of the 2020 low. That is the inflection point that is now close and, one way or the other, may well dominate 2024.

On the SPX daily chart you can see that the 2023 high is just 40 handles short of the retest of the all time high at 4818.62, that a retest of the 2023 high at 4778.01 would start possible daily RSI 14 and RSI 5 sell signals brewing, and that last week there was a volume spike higher than any previously seen on the chart below, suggesting that a significant reversal may be very close.

SPX daily chart:

On my SPX daily 45dma chart below you can see that the highs last week were 6.174% above the 45dma, which is very much at a level where a mean reversion may be close. The 45dma is currently at 4483, and a 50% retracement of the move up from the October low would currently be in the 4451 area.

SPX daily 45dma chart:

The other two all time high retests that I was expecting to see in this scenario were the all time high retests on NDX and Dow, both of which have made new all time highs in the last few days. A retest of the current all time high on NDX at 16860.68 would also set possible high quality daily RSI 14 and RSI 5 sell signals brewing.

NDX daily chart:

A retest of the current all time high on Dow at 37.6k would also set possible high quality daily RSI 14 and RSI 5 sell signals brewing. I would note that both are already brewing on IWM so if the short term high retests are seen on SPX, NDX and Dow, then I should have high quality daily RSI 14 and RSI 5 sell signals on all four of the main US indices that I watch. That could certainly deliver a very interesting start to 2024.

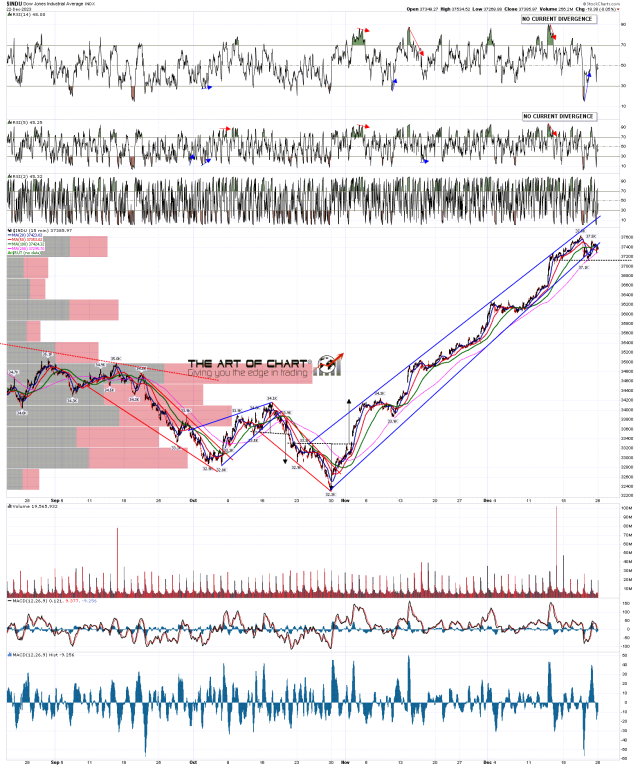

INDU daily chart:

The best quality of the rising patterns from the October low on the US indices is on the leader for much of the move, the Dow Industrials index. The rising wedge there broke down slightly last week but may extend higher. There is a really nice resistance trendline on this wedge that I am not expecting to see broken unless there is a bearish overthrow on that as a significant high is made.

INDU 15min chart:

Do I think that a new all time high is coming on SPX in coming weeks and months? Yes, though we may see a strong retracement first. If we are going to see that all time high retest soon then my lean would be that we would likely see that latest in the first week of January. The most bullish leaning day this week is today, leaning 71.4% bullish, so I am leaning towards seeing retests of the 2023 highs on SPX, NDX and Dow today and maybe SPX continues on from there to an all time high retest in the next few days.

Do I think a significant high is close and a strong retracement likely to start soon? Yes. Everything is lining up for that here. What happens after that strong retracement is harder to call, but on SPX, NDX and Dow particularly, this is a huge inflection point area to either be bulldozed on the way up, or failed at on the way down. What happens here likely dominates 2024 and perhaps also 2025.

Is the way forward clear for bulls with the improving inflation numbers? No. Energy prices have flattered the inflation numbers over recent months but both CL and NG are likely forming lows here. The yield curve is still inverted on bond yields and that is a strong indicator for recession when the inversion ends. It hasn’t ended yet, but likely that inversion ends in 2024, and there is a strong chance of recession then. Recessions do not tend to be good for equity prices.

A couple of announcements today. Stan and I did our 2024 forecasts Chart Chat at theartofchart.net on Sunday 17th December and if you would like to watch that you can see that embedded on our December Free Webinars page, or directly here. Forecasts as usual on equity indices, bonds, energies, precious metals and other commodities & one of our best I thought.

We are also running our annual end of year sale at theartofchart.net offering an additional 20% off annual memberships in addition to the 20% off we usually offer. If you are thinking of signing up for an annual subscription you can check that out here.

If you are enjoying my analysis and would like to see it every day (including a daily premarket video) at theartofchart.net, which I co-founded in 2015, you can register for a 30 day free trial here. It is included in the Daily Video Service, which in turn is included in the Triple Play Service.