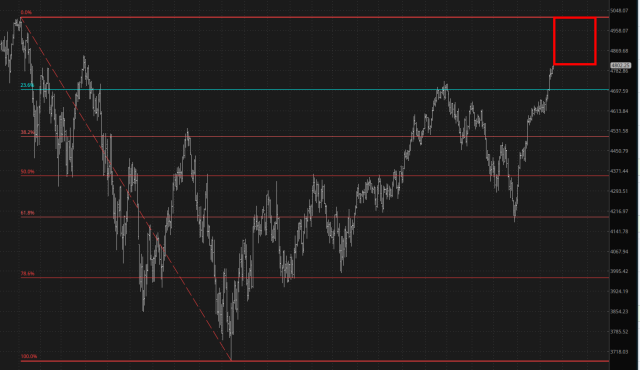

With the exception of crude oil, we awake yet again to an all-green morning (at least as I am typing this, about 90 minutes before the opening bell). There is less than 200 points between the present price level and lifetime highs for the /ES, and you just know how many people would love to slap “Lifetime Highs” on the top of USA Today. Many indexes, of course, already have such a declaration, but the S&P isn’t quite there yet. (I am referring to the adjusted futures contracts; the cash index is a mere 58 points away!)

Of course, such a rapid rise does tend to go to people’s heads.

And I’d like to point out that, at the start of 2022, quite unaccounted, the ascent just kind of……..stopped. It’s sort of like everyone looked at each other and asked, “What are we THINKING?” I’ll be quite interested to see what things look like a week into January, to see if the fever has broken.

Crude oil is one of the very, very few places that actually has a legitimate bearish setup, and /CL has been tumbling fairly steadily for a few months now.

In spite of the daily rise to new highs, it seems that the volatility indicator has had its fill of being banged down to oblivion. The 11-handle from last week is, for the moment, in the rear-view mirror, which is truly odd, since all we do is push higher every day with neither rhyme nor reason.