Preface to all posts: Instead of my typical ETF videos over the weekend, I went through all the charts and put them into certain groupings. In this post, I cover the ETFs that seemed appropriate for the grouping mentioned in this post's title.

This theme is about financial instruments which are, for lack of a better term, tired. Starting with commodities, you can see the pink zone creating a top (at a glacial pace) and then a languorous range, tinted in green.

More specifically, gold has been grinding away beneath its two-year-big blue trendline, and it is ever-so-slowly hammering out what could be a short-term top.

The S&P 100 fund has spent almost two years working its way higher within the confines of this channel. It had so much strength this week, it managed to peek its high a little bit above the top trendline.

A shorter-term chart, the NASDAQ, has a couple of “tired” things going on. First off, on Friday, it reached a lifetime high, but it sank for much of the day and failed to make a new high. (These days, that counts as a “failure”). Second, the fact it broke below its wedge, albeit briefly, may suggest weakness next week.

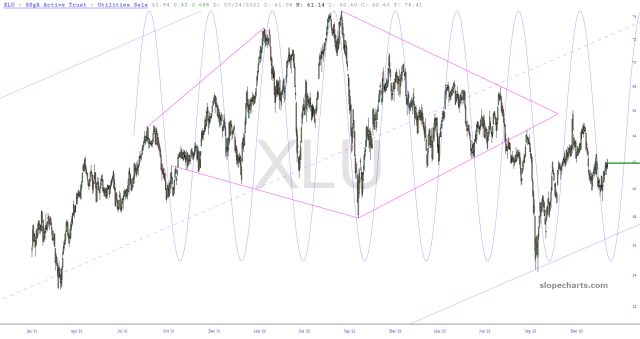

Our inscrutable buddy the Utilities is being frustrating. It has been fighting back for the past week or so, and it should be clear in the next few trading days if this is going to be another failed sinewave or if starts to behave itself properly again.