Preface to all posts: Instead of my typical ETF videos over the weekend, I went through all the charts and put them into certain groupings. In this post, I cover the ETFs that seemed appropriate for the grouping mentioned in this post's title.

First, I’ve got a shipment here for the boys at Elliott Wave. Can someone tell me where to drop these?

This post has some bullish charts. We begin with IYT, which is for the Dow Transportation Index, which closed at a lifetime high. It should be noted that the index itself, the $TRAN, is far short of its actual high of November 2021, but the IYT takes dividend payments into account.

Next is XLF, which is the Bank sector. The darlings at banks have benefitted from the infinite largesse of D.C. and Yellen, and that is reflected in the record high prices. Just one year ago, the wheels were totally coming off the banking industry, but thanks to literally hundreds of billions of dollars of “help”, the banking industry is doing just peachy, thanks so much.

Lastly is the Consumer Discretionary fund, which I mentioned back on the 15th as a bullish play.

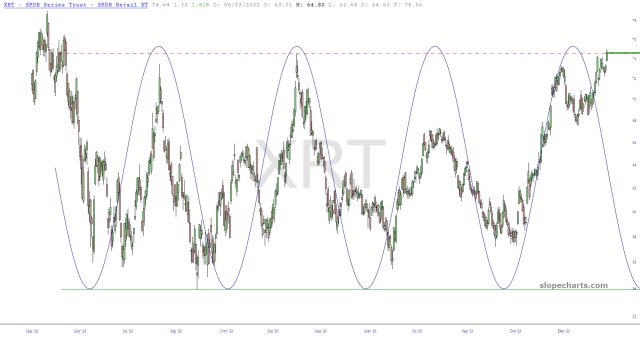

The one rather “iffy” chart is the retail sector, which until recently was complying magnificently with a sinewave pattern. Regrettably, it has defied this pattern utterly and is at its highest level of two years. There’s a chance that this sucker is still range-bound, but if so, it better start falling and falling right away, because the way it looks now, it is making a bullish escape from a very substantial range.