From Substack:

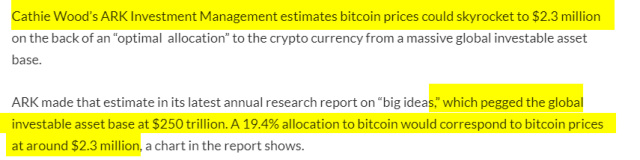

Disclaimer: Prices can go a lot higher regardless of “Narrative”. Everyone who has a vested interest in higher prices are selling the stories that will try to make it so.

That is why it is counter intuitive to consume too much financial content. Even mine. That is also why my podcasts are so short vs what you see out there in the marketplace. The market already has priced all below news into prices already. That is also why I note that listening to earnings is for entertainment only. The price action is king.

When you can ingest “NARRATIVE” data like earnings and sell side packaged news and still function as a trader and win, you are making huge progress in the psychology of trading. So, before I get into the narrative data, I want to point out charts and “What Stuck out” section first! Because price action and charts are more important than news and narrative. I would say the healthy ratio of attention or head space for a good trader is at minimum 90:10. 90% price action and psychology vs 10% news, earnings and narrative.

(more…)