On this quiet Sunday, I am regarding the week ahead with a mixture of excitement and anxiety. I have truly been enjoying trading for the past 2.5 weeks (yes, I have to be that precise!) although I’ve been beating myself up nonstop over missed profits.

Japan hasn’t been a topic of interest for me for years, but in recent days, it’s the belle of the ball. The Yen has been strengthening………..

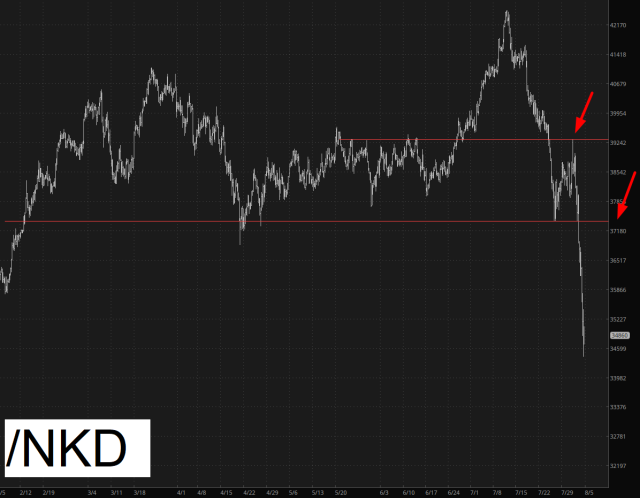

…………which in turn has been absolutely blowing up the Nikkei 225 futures. This wipeout has been reflected around the world (although I obviously hope this is just an appetizer for the main course to come). In both of these charts, I have highlighted with arrows the prior “bounce back” and the maximum level for any second bounce-back.

The futures open soon, and just as a recap, here’s kind of where I’m at:

- Ten bearish positions (long puts expiring from October through June 2025);

- 30% cash ready for more positions;

- The only germane earnings report being JACK after Tuesday’s close

- A fervent desire for a pop HIGHER to get shorter!

- Small, aggressive, high-risk long positions in INTC and AMD call options