There is one chart I’ve looked at repeatedly but could never bring myself to short since it is relatively thinly traded: Huntsman (HUN):

If one glances at the website, it isn’t particularly clear what they do except for “enriching lives through innovation“, whatever that means.

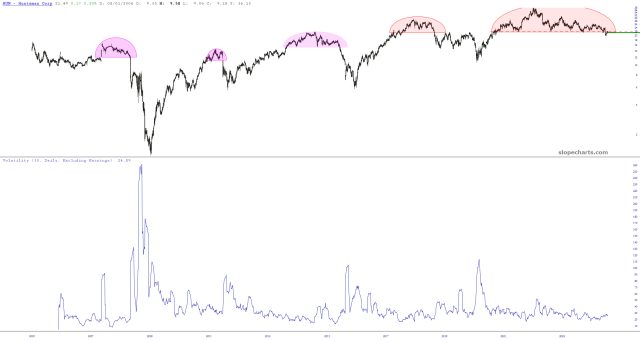

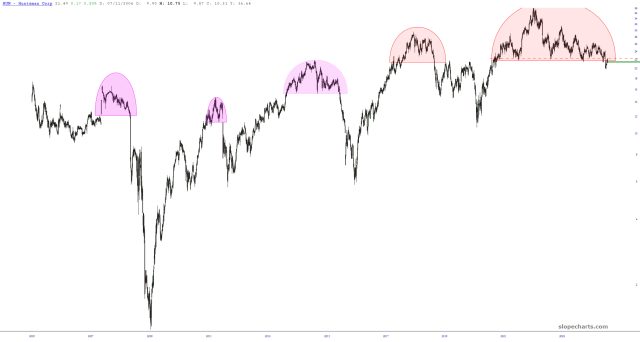

Happily, I’m a chartist, not a fundamental analyst, so I’m much more focused on the price action. As such, this company definitely has demonstrated its propensity to top out and tumble with some regularity.

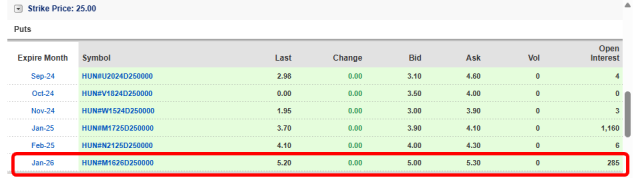

Thus, even though I’ve passed on this opportunity dozens of times, I decided to take a moment to look at the options chain, and it isn’t that terrible. In fact, what I was drawn to was a put option that was wayyyyyyy in the future (a full 500 days!): the January 2026 $25 put. I figure, hell, if the world is going to go through an economic collapse, might as well give this sucker a ton of time, since the time premium is just about zilch.

You can see in the long-term chart below, augmented with the implied volatility, that one pays very little for the uncertainty of this beast. The stock is $21.50 now, but I don’t think it’s out of the question for this to be in the single digits in the timeframe of these options. I mean, sheesh, for a $5.20 purchase price, you’re getting $3.50 of intrinsic value with nearly one and a half freakin’ years of time premium.