Here are my eight bearish positions in my smaller (Schwab) account. All of these are long puts expiring between January 2025 and January 2026.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Here are my eight bearish positions in my smaller (Schwab) account. All of these are long puts expiring between January 2025 and January 2026.

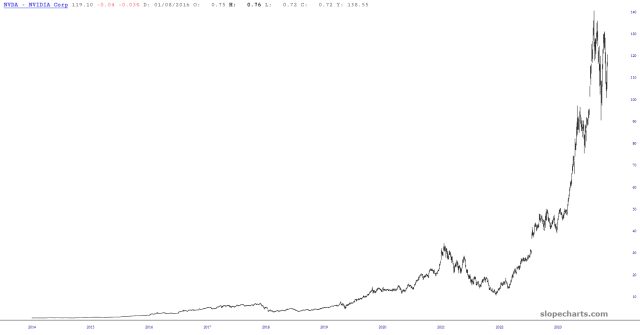

While Jensen Huang is trying to convince everyone that a multi-trillion-dollar valuation of NVDA is just the beginning of a new “industrial revolution“………..

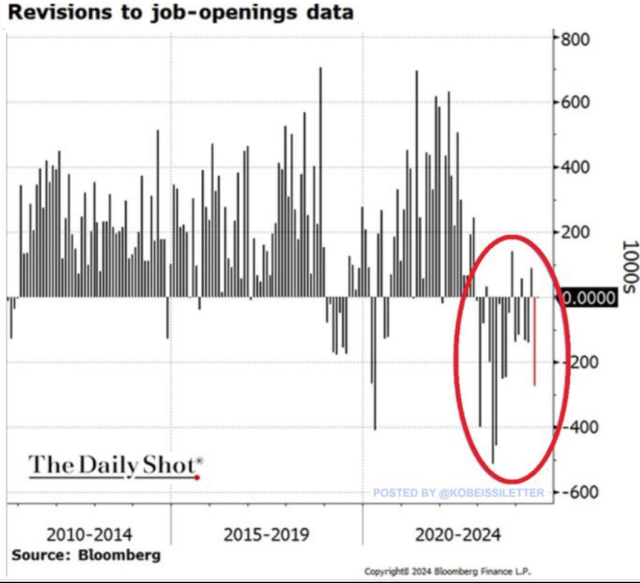

Once a week, we all sit at the edge of our seats for the latest government-created report on jobs. That’s where all the focus is. Where virtually none of the focus goes is on the revisions of erroneous data propagated earlier.

Well, it’s pretty interesting, since for about a dozen years, almost all the data under-reported employment growth. In the past 19 months, however, a full 15 of them were dead wrong, and the few times the jobs data was later increased, it was by very small amounts. It seems to me this is no accident.

Real estate and homebuilding stock have been remarkably strong lately. The very long-term patterns suggest that prices are very elevated right now, but in the short term, they have been astonishingly robust, with the home construction fund ITB at record highs.

The broker/dealer index continues to be an absolute honey of a pattern. I’m not trading this directly (nor am I acquainted with any way to do so), but I do think the clarity of this bearish setup makes the $XBD a steadfast ally of the bears. So long as it remains below that broken wedge – – and, ideally, slips hard away from its completed apex – – I think this will help resume weakness in the overall market very soon.