I’ve spent a lifetime working with words, and the two that leap to mind right now would be “surprising” and, without a doubt, “discouraging.”

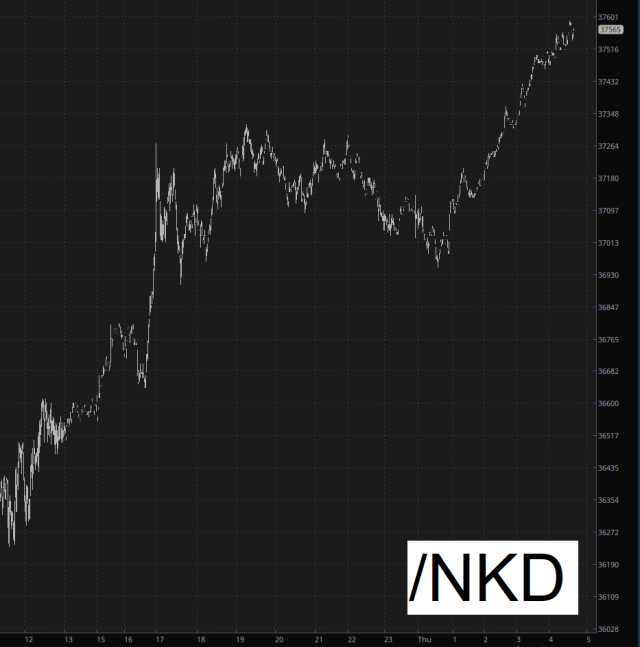

Yesterday evening, I had breathed a sigh of relief that not alone was the FOMC behind us, but that the rally that ensued had totally sputtered out. The rally got its second breath, however – – and a third, fourth, and fifth breath – – and blasted markets, thanks to the follow-through from overseas markets.

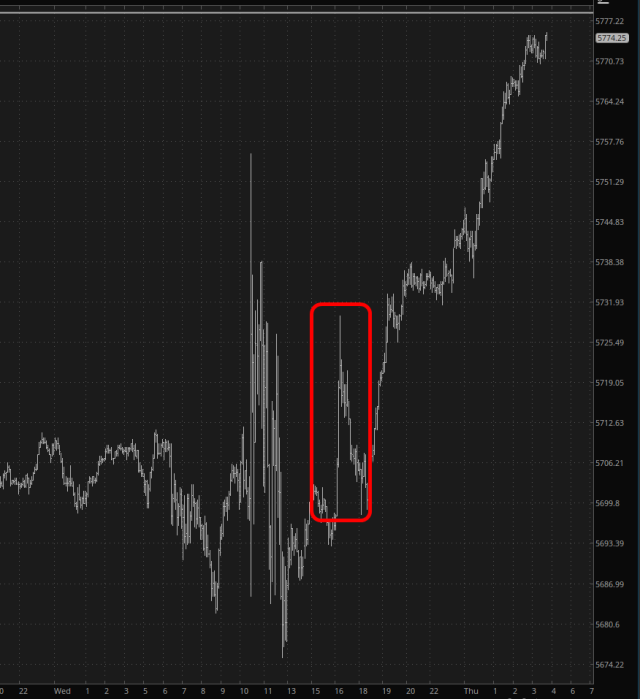

For a while, it seemed like that rally was sputtering out too. This second failure compelled me to write a post to my premium members with my latest observations, and since fate is a cruel mistress, I composed this post just about the time that it seemed we were, once again, in the clear. And yet, from that point, it rocketed higher and didn’t bother looking back even once.

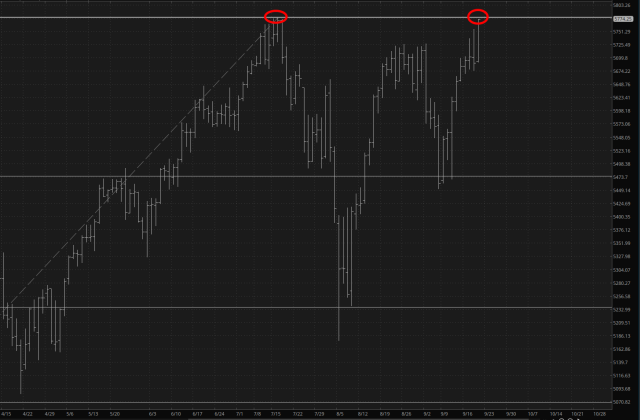

As of this component, we are at lifetime highs on most indexes, including the /ES, shown below.

As for tech stocks, they still have a series of lower lows on the /NQ, but that’s a pretty thin reed to hang any bearish argument upon.

It seems to me that September’s reputation as some kind of seasonal nirvana for bears may have expired. Sure, it fell for a few days (four, to be precise), but since then, it’s been straight up.

Let’s just say I’m feeling deeply troubled by all of this, and I woke up even earlier than I normally do to take a look at the landscape, which was a total gut-punch. I’ve been doing this my entire adult life, but this is one of those times I’m going to need to curl in a ball for a while and think. See you later.