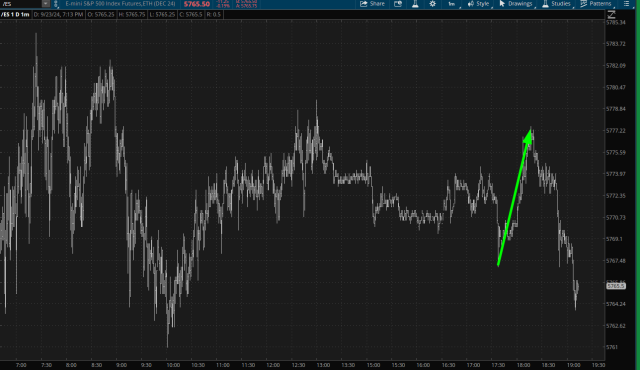

On Monday evening, the futures markets were universally red. Not dramatically, but red, nonetheless. Out of the blue, every single futures market shot higher. You can imagine the three-word question which popped into my head.

It didn’t take long to find the culprit. The news was slathered with stories about China pouring yet more stimulus into their corrupt, beleaguered, and completely fake prosperity.

I could only roll my eyes. Earlier today, I made a little impromptu speech on my show about how in the old days, stocks measured the prosperity and prospects of corporations, whereas now the stock market is little more than a metric for how much the host country’s central bank is willing to stimulate

Thus, for the billionth time since late 2008, a central bank hurled more of their nation’s future income into the present, trying to keep this farce going just a little bit longer.

Then the most interesting thing happened……………

In about half an hour, the entire positive effect from untold billions of dollars was rendered moot.

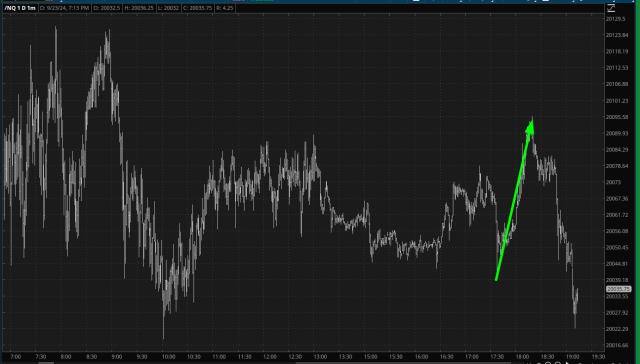

Same for the /NQ:

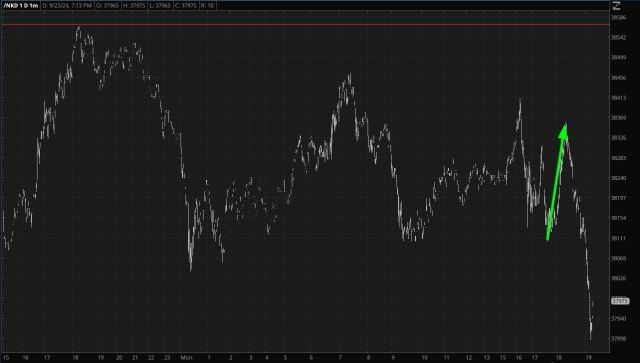

The same held true for the Nikkei 225, which was briefly, umm, stimulated. The worldwide equity futures markets are basically a gaggle of high school senior boys having a really successful prom night.

Listen, I trust this market about as far as I can throw Huell Babineaux from Breaking Bad. As far as I know, futures may be at record high by the time you read this. The point I’m trying to make is that the central bank magic, by my estimation, is getting to be really, really old and is losing its efficacy, to put it gingerly.