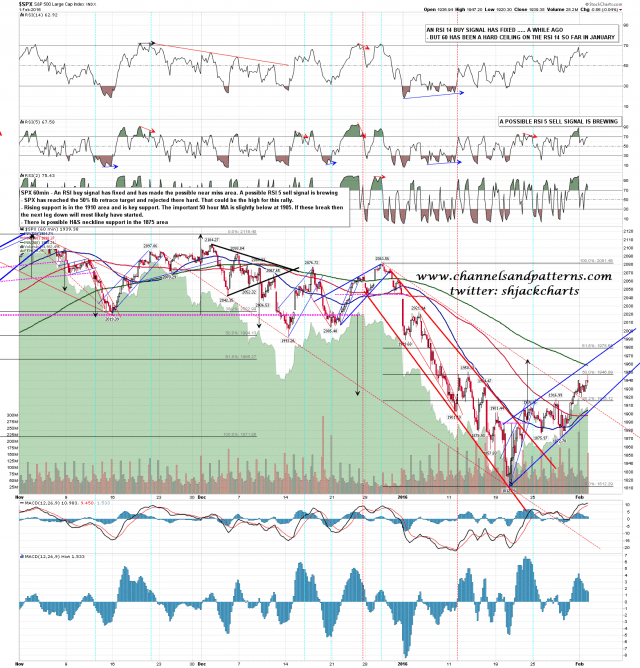

SPX had a strong day yesterday but has given it all up overnight. 15min RSI 14 and 60min RSI 5 sell signals are brewing and may well fix this morning. This is a possible rally high, especially as SPX tested the 50% fib retrace target at the high yesterday.

The important support levels on SPX this morning are rising support in the 1910 area and the 50 hour MA in the 1905 area. If SPX breaks below those levels then the rally bear flag has broken and the first big target is a retest of the January low at 1812. While those levels hold SPX still has a shot at reaching the 61.8% fib retrace target at 1978. SPX 60min chart:

On ES we are seeing a retest of broken triangle resistance at 1912, and the globex low was at the weekly pivot at 1909. If 1909 is broken and converted into resistance then again, the next leg down has likely started. ES Mar 60min chart:

If support holds this morning we can still see new highs on this rally. If it breaks then the overall downtrend has likely resumed.