Fly like a butterfly, sting like a bee…

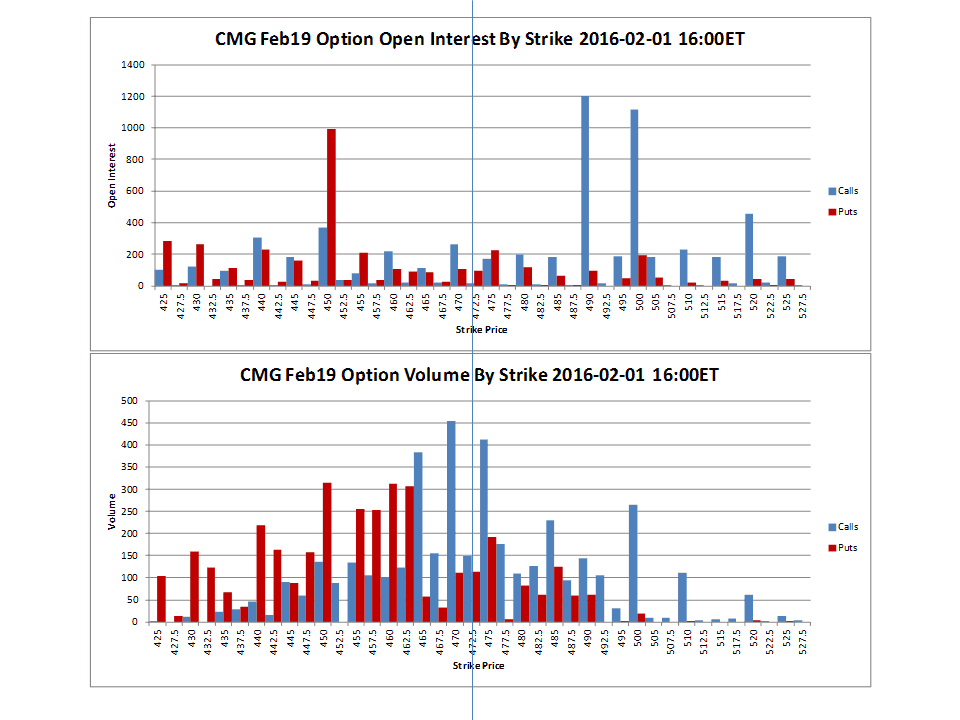

The pre-earnings option analysis for CMG is interesting. We see lots of volume churn in this week’s options in bullish strikes, but little to show for it in fresh, sustained open interest.

The February monthly option expiration show notable open interest in bullish strikes, and considerable activity among the puts – most likely closing bearish positions on the CDC bulltard news.

The February monthly option expiration show notable open interest in bullish strikes, and considerable activity among the puts – most likely closing bearish positions on the CDC bulltard news.

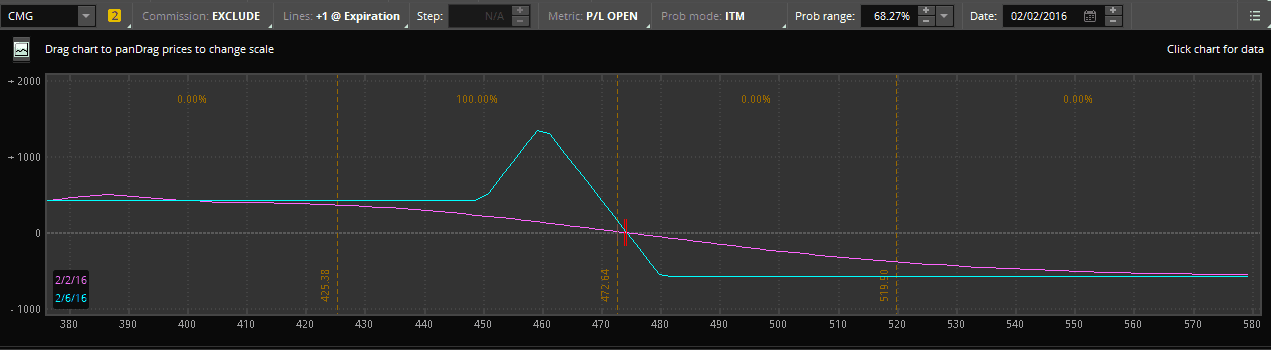

One strategy we like to deploy is to structure pre-earnings broken wing butterflies, favoring the likely direction of the earnings blast. To get bullish on CMG for Tuesday’s after hours earnings release, you would have to believe CMG’s health issues are behind it, and the promise of future recovery overcomes dismal 2015Q4 earnings. Bears would need to believe it’ll take more than the next quarter for CMG to recover.

The case for the bulls is possible, but on this end it’s tempting to parlay a portion of today’s GOOGL bullish proceeds (assuming they hold tomorrow) into a bearish put broken wing butterfly (BWB) spread:

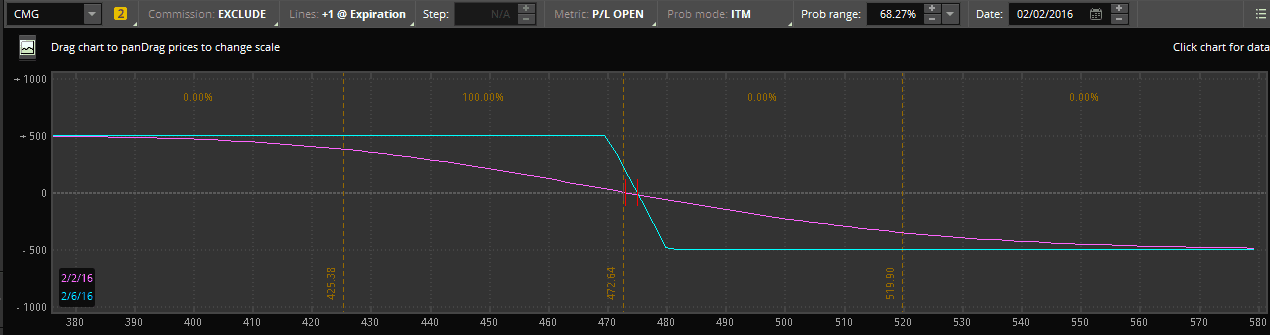

A simple vertical is also possible with a 1:1 risk:reward profile:

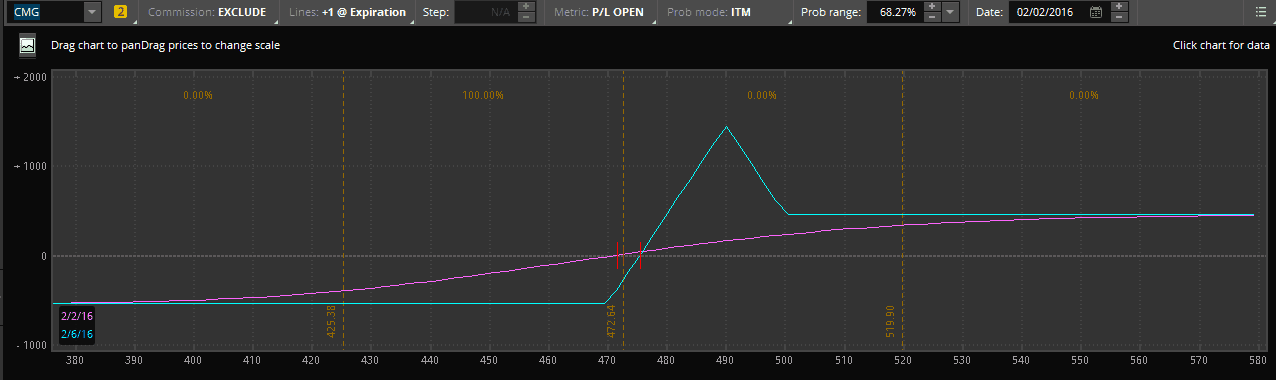

Of course, there are two sides to every trade. For CMG bulls, a similar bullish call broken wing butterfly spread is also possible. In full disclosure, we find it tough to get behind this trade. If we cannot get good pricing on the bearish put BWB, then we will most likely just take a pass on CMG and move onto the next trade. We like to see a clearer picture with the option analytics.

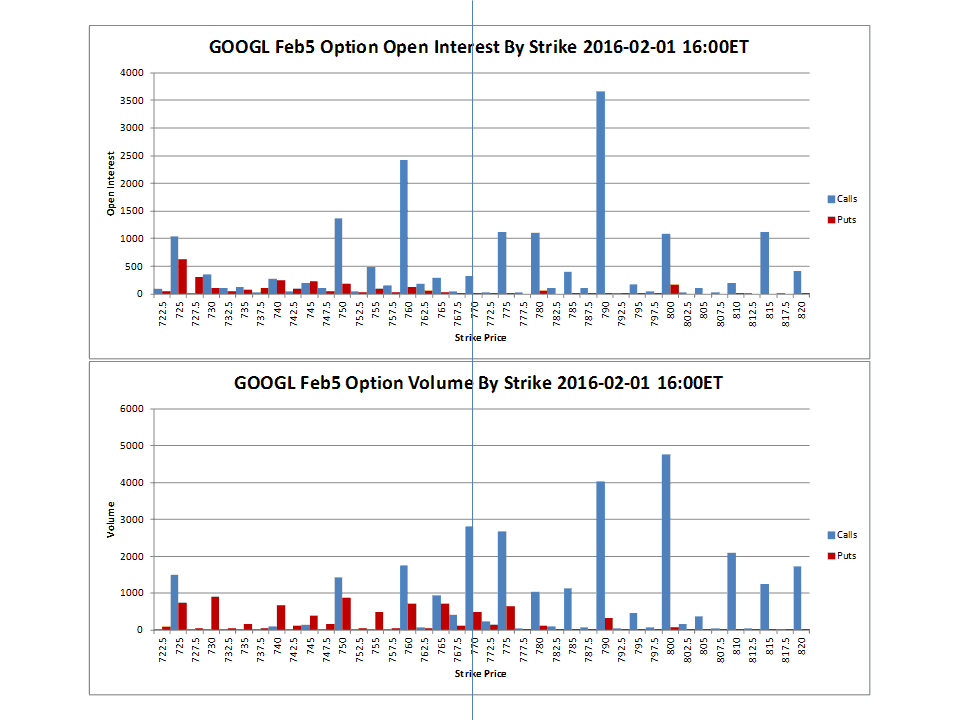

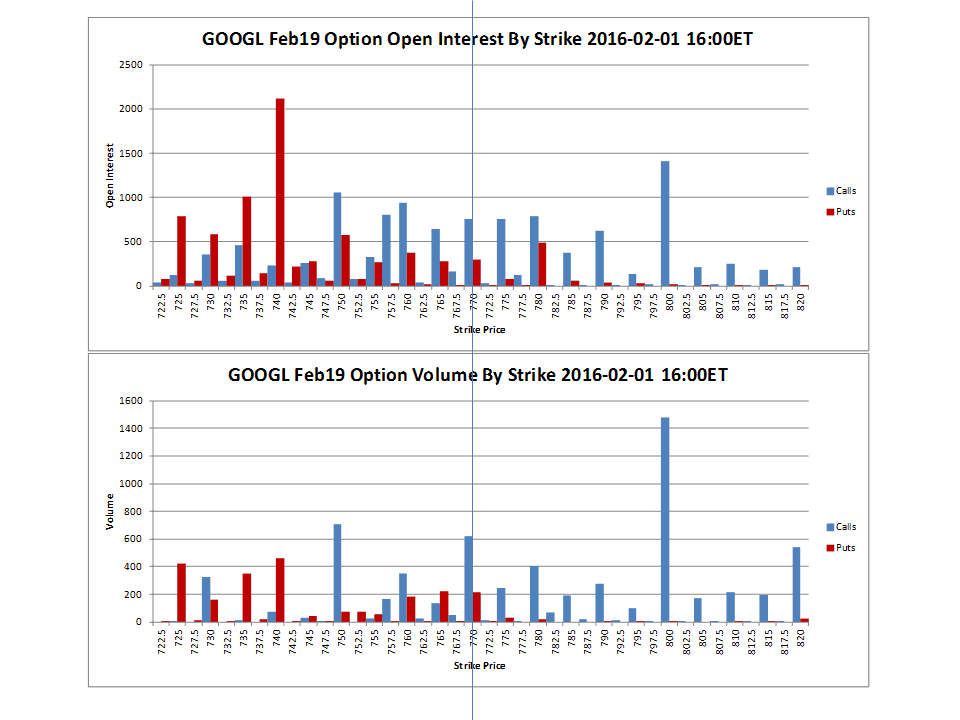

By comparison, here’s how the option analysis looked prior to GOOGL earnings on Monday – notice the consistent sea of blue. The front week option expiration shows clear and decisive bullish strike activity and open interest. Even the February monthly options support the story. Of course it was possible GOOGL could surprise to the downside, but this was not likely. It’s also possible a nasty round of profit taking unwinds the overnight moonshot – the last price clocked in around ~803, and hopefully this holds into the Tuesday market open so we can close the GOOGL bullish BWB placed earlier on Monday.