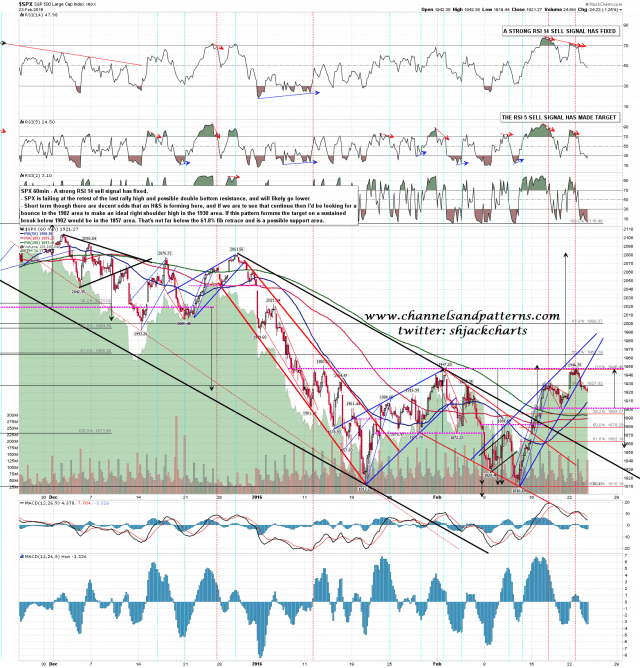

SPX broke down yesterday and has fallen further overnight. What I’d like to see today is a bounce from the 1902 area back to backtest the 1930 area and form the right shoulder on an H&S that would then target the 1857 area on a break below the H&S neckline in the 1902 area. We’ll see whether that plays out today.

Important support is at the hourly 50 MA at 1908, so if we are going to see that right shoulder bounce, I’d be looking for that from a low in the first hour, without too much time below that support level. SPX 60min chart:

Are there other options here? Yes, this could be an asymmetric double top and ES could then fall straight through that possible H&S neckline, which is at 1898 on ES. There is further support just below as well however at the daily middle band in the 1893 ES area (1897 on SPX), and that would need a solid break to kill off this support area. ES 60min chart:

Whatever happens this morning I’ll be watching the 61.8% fib retrace in the 1861 SPX area when reached as possible support. On a conviction break below I’d be looking for a retest of the 1810 low and likely lower.