Yesterday’s knife fight resolved up and SPX closed the day at another test of the daily middle band from below. SPX gapped over the middle band at the open and looked as though a trend day was in store until SPX/ES hit declining resistance from the high. That broke up slightly on SPX and has been tested at the high on ES, but held so far. Bulls need to break above 2380 SPX / 2377 ES and bears need a close back under the daily middle band, currently at 2363. Whichever way this breaks may well determine direction for the next few days.

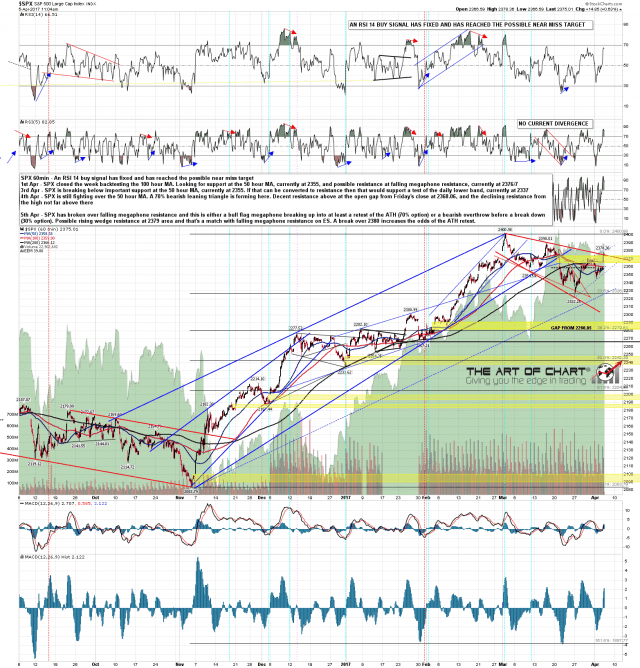

SPX 60min chart:

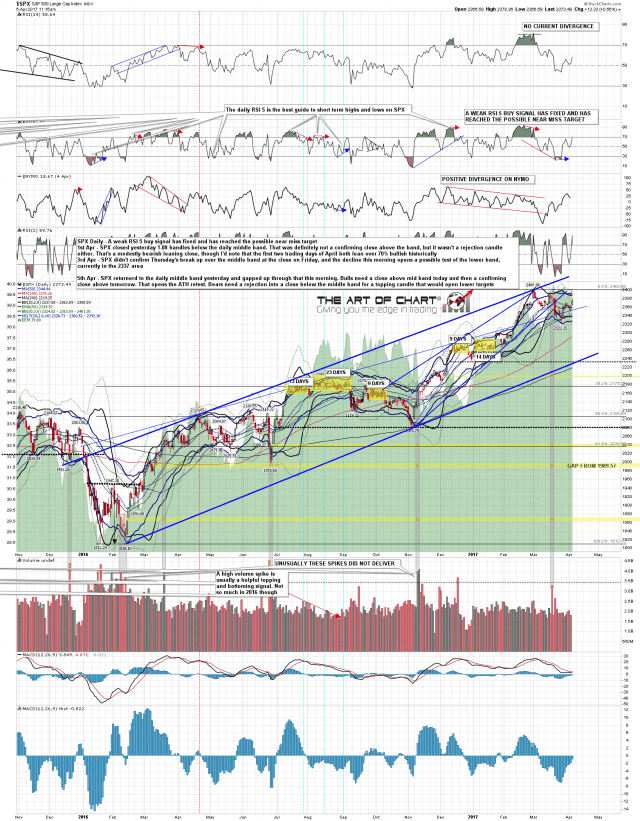

SPX daily chart:

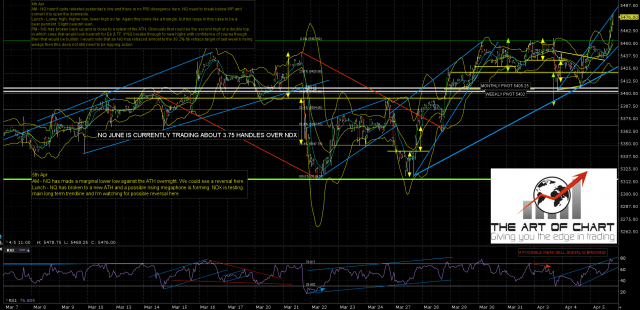

At the time of writing ES is retesting today’s high. If that holds then there is a decent looking little double top setup here on both SPX and ES. ES Jun 60min chart:

NQ has been making marginal new highs since I capped this chart and those highs are crawling up the megaphone resistance trendline, with tests at the candle shadow highs for each of the last four hours. That is now clear and decent resistance. NQ Jun 60min chart:

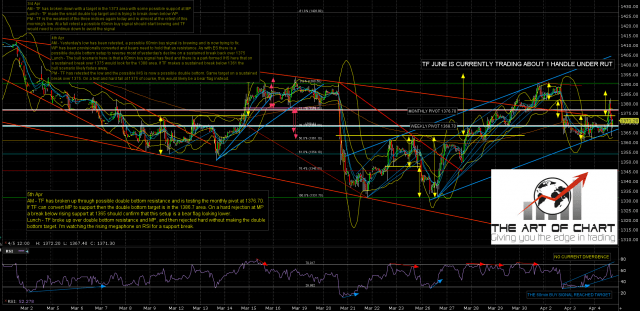

TF was the most interesting this morning however with TF breaking up over double bottom resistance and then monthly pivot before a hard rejection back to weekly pivot without making the double bottom target. That was pretty bearish and if TF follows through to the downside then most likely all three indices have been rallying into a lower high and would be topping out at the moment. TF Jun 60min chart:

Bulls have the advantage but there are very much signs that they may drop the ball here. A sustained break over 2380 SPX sets up a likely retest of the all time high. A close back under 2360 SPX likely delivers a retest of Monday’s low and very possibly considerably lower.