Even if SPX resolves up here, and I’m leaning slightly towards that, the bears have impressed so far this week just by putting up an impressive fight on two consecutive days with very strong historical stats. As a general rule bears are barely noticeable as roadkill on days like these, so regardless of the outcome that is a show of some strength.

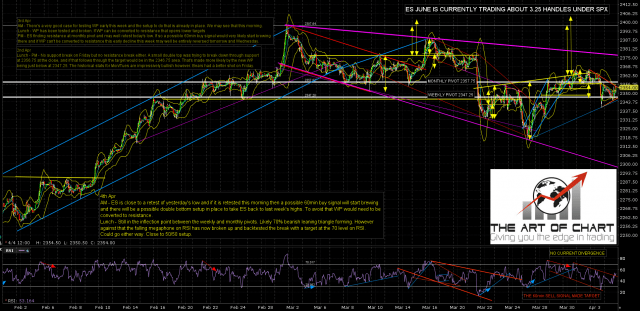

However to win this particular battle bears need to convert first the 50 hour MA and then the weekly pivot on ES, and that’s not happened so far at least. The longer that support holds the more dip buyers will be encouraged.

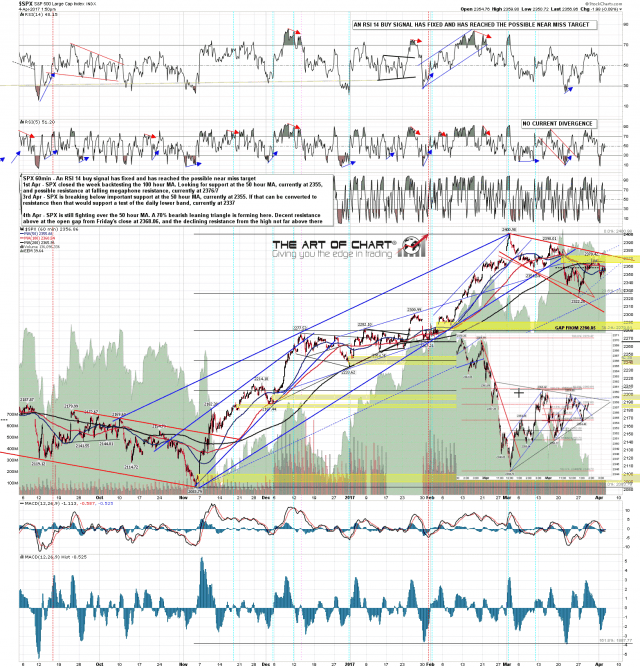

On SPX a triangle is forming that would lean 70% bearish, but at the moment that is trying to break up. Key resistance above is at the open gap at Friday’s close at 2368.06. That is a possible breakaway gap down until it is filled. SPX 60min chart:

Resistance yesterday was at the monthly pivot at 2357.75, and ES is close to testing that again this afternoon. ES Jun 60min chart:

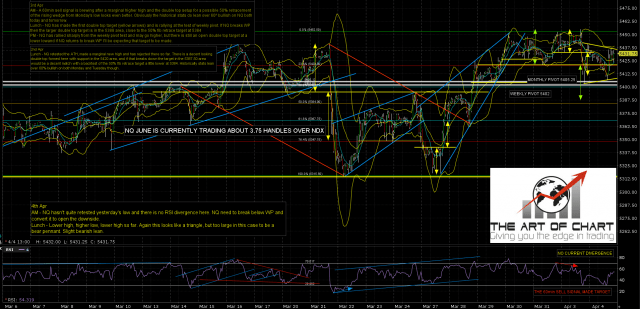

NQ is also close to a test of yesterday’s high. NQ Jun 60min chart:

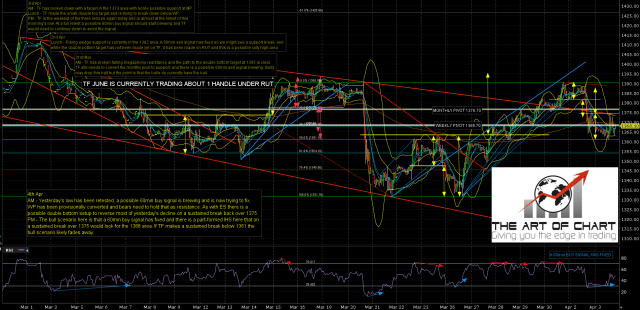

The obvious bull setup though is on the TF chart. A 60min buy signal fixed at the open and there is a part formed IHS that on a break back over 1375 would look for 1388, almost entirely retracing the decline from the last high. That said, TF is at 1367 at the time of writing and is showing no current sign of breaking up. On a sustained break below yesterday’s low the bull setup would fade away but it’s looking very promising here. TF Jun 60min chart:

Overall this is a coin toss for direction here, leaning slightly towards the bulls perhaps. Support and resistance is clear. Waiting for a break.