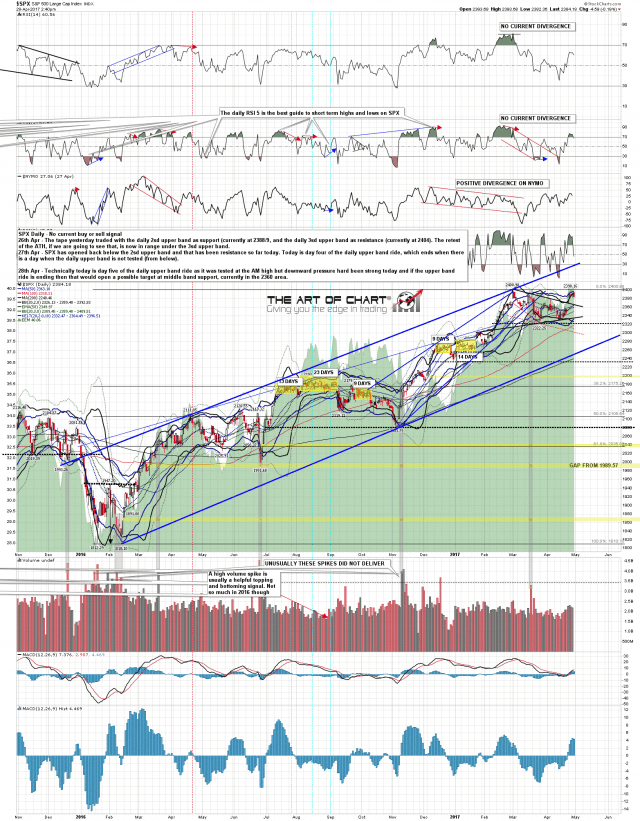

Bears have dominated the day today, though that hasn’t actually delivered a lot of downside on SPX or NDX. We may see a late rally into the close. Bigger picture this is day five of the daily upper band ride and if we see a weak close today and that follows through on Monday that would open a possible test of the daily middle band, currently at 2360. SPX daily chart:

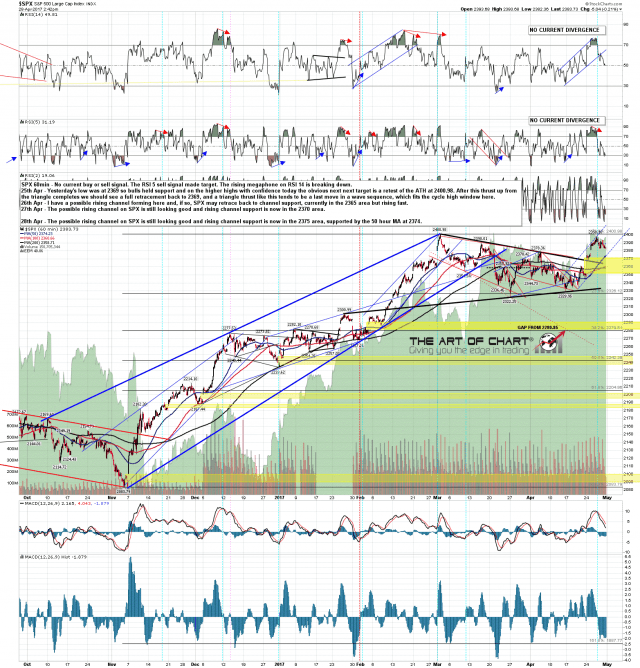

The possible rising channel that I posted on Wednesday is still looking good. Channel support is now in the 2375 area, supported by the 50 hour MA at 2374. A break below channel support would be a significant technical break. SPX 60min chart:

The futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

On ES falling support is now in the 2375 area and is likely to cross SPX rising channel support on Monday morning. The 60min sell signal has now reached the possible near miss target. ES Jun 60min chart:

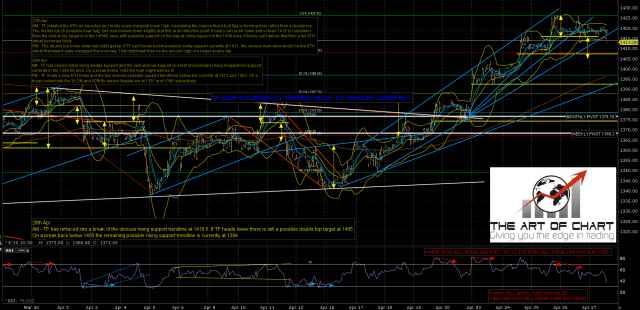

On NQ the initial rising wedge evolved into a rising channel and that rising channel has now broken down. The high on NQ could be in, but until we see a break down with more enthusiasm my working assumption is that the current high on NQ requires at least a retest. NQ Jun 60min chart:

On TF the 60min sell signal has made target and rising support is now in the 1393 area. That is a decent looking match with trendline support below on ES/SPX. These may require a test before any return to retest the highs. TF Jun 60min chart:

I think what we are seeing here is most likely what we call the low before the high, which is the last decline before a swing high is made. Some technical damage has been done, with SPX breaking below yesterday’s low, and NQ breaking the rising channel. It could be that the swing high is already in, but until we see more evidence it’s more likely that there is one last retest coming.