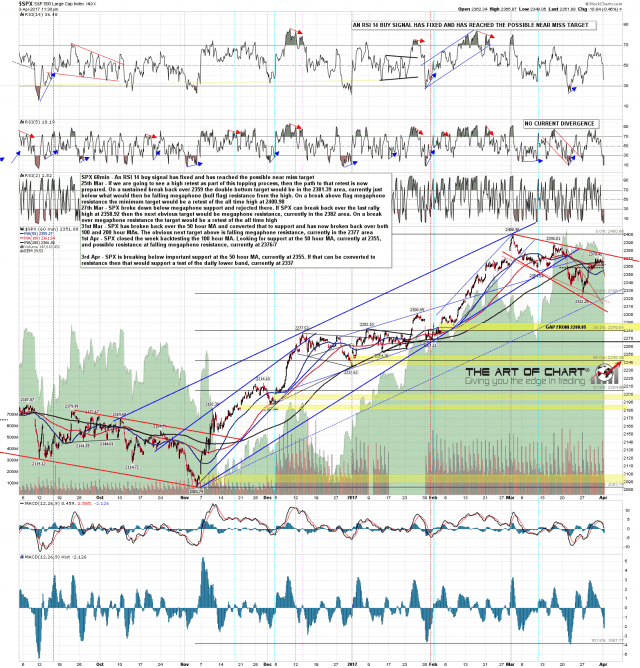

Bulls needed to confirm Thursday’s break above the SPX daily middle band with a second close above the middle band on Friday, but didn’t manage it. We’re seeing a reaction to that fail so far today. SPX has broken below important trend support at the 50 hour MA, currently at 2355, and if that can be converted to resistance then that would support a possible retest of the daily lower band on the daily chart. SPX 60min chart:

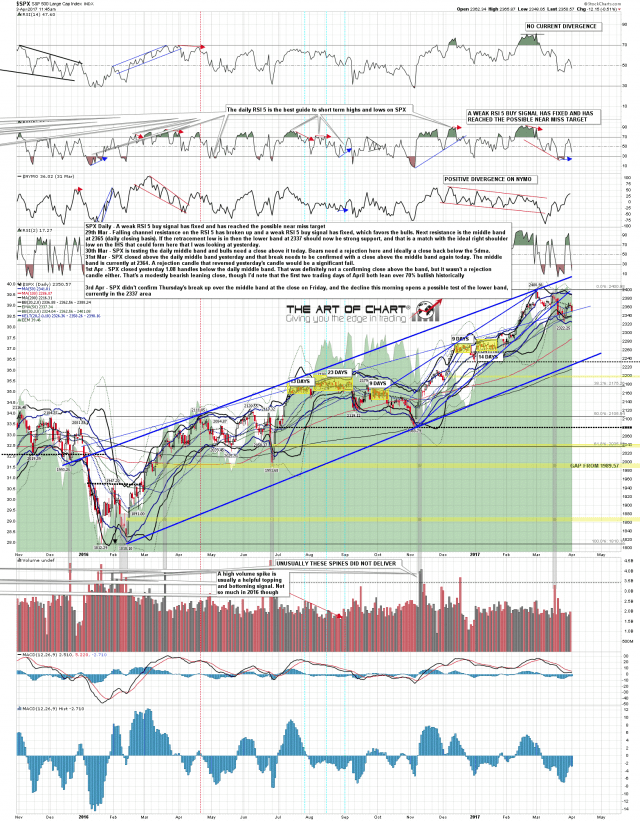

The daily lower band is currently in the 2337 area, slightly under the 50dma at 2441. SPX daily chart:

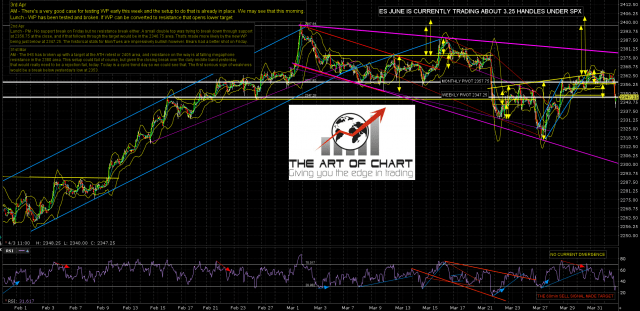

The open 60min sell signals on ES and TF have made target this morning. A sell signal fixed on NQ close to the open and that has made target too. The key level on ES this morning is the new weekly pivot at 2347.25, and bears need to convert that to resistance to open up the downside. ES Jun 60min chart:

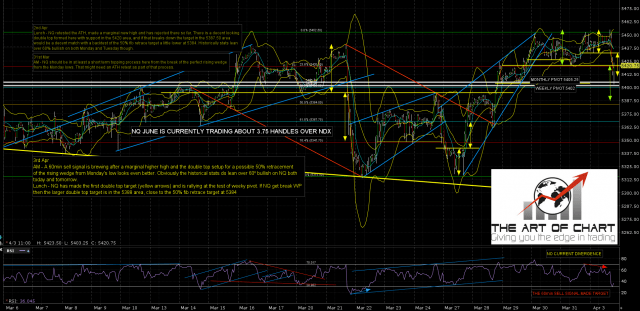

NQ made the 60min sell signal target and the smaller double top target, and tested the new weekly pivot at the low. On a break below the larger double top target would be in the 5387 area, close to the 50% fib retrace at 5384 of the move from last Monday’s low. NQ Jun 60min chart:

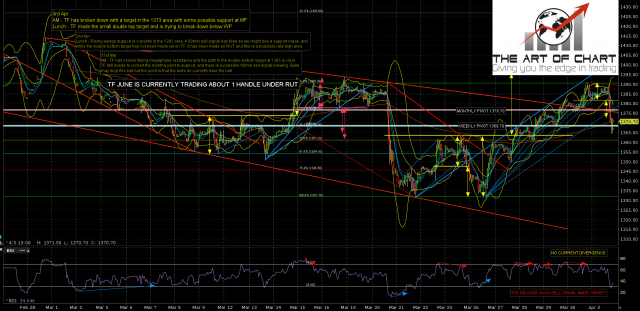

TF is also testing the weekly pivot there. Conversion to resistance opens the downside. TF Jun 60min chart:

I was saying in the monthly public Chart Chat yesterday at theartofchart.net yesterday that the closing setup on Friday leaned bearish, but that the historical stats for today and tomorrow leaned over 70% bullish on SPX and over 60% on NDX. That’s a heavy headwind for bears early this week but they’re doing ok so far. That said most of the downside targets have now been hit, and all of the shorter timeframe sell signals have now made target. Keeping the rest of the day negative will be tougher. If you’d like to see the recording of yesterday’s Chart Chat you can see that here.