After the initial decline on Monday the week has been a tug of war between bulls and bears with the bulls trying to break back up over the daily middle band and bears trying to break down through the weekly pivot. As I write neither side has a clear advantage, though the bulls have an edge just because SPX is testing resistance rather than support.

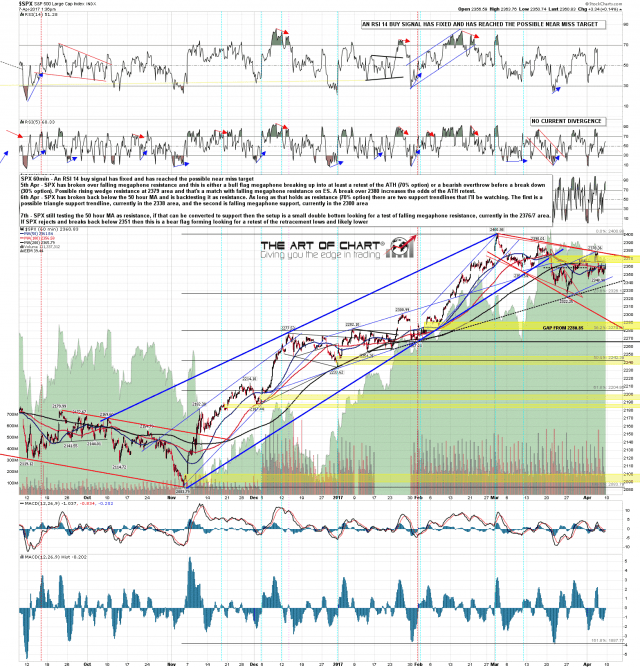

The short term setup here is promising for both bulls and bears. SPX is trying to break over the 50 hour MA and the daily middle band, both currently at 2361. If the 50 hour MA can be broken and converted to support then the short term setup is a small double bottom looking for another test of falling megaphone resistance, currently in the 2376/7 area. If SPX fails at this attempt then this is likely to be a bear flag channel forming, looking for a retest of the retracement lows and likely continuation lower. SPX 60min chart:

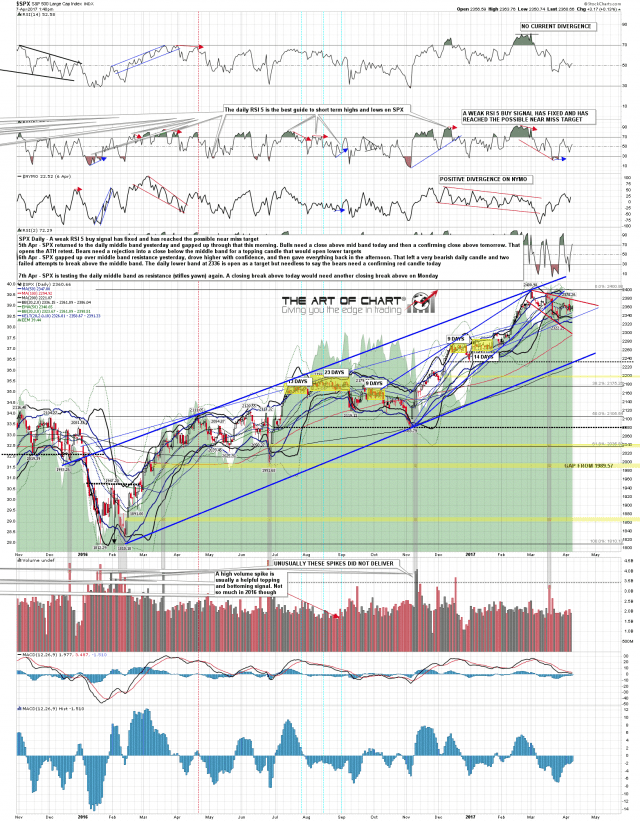

SPX daily chart:

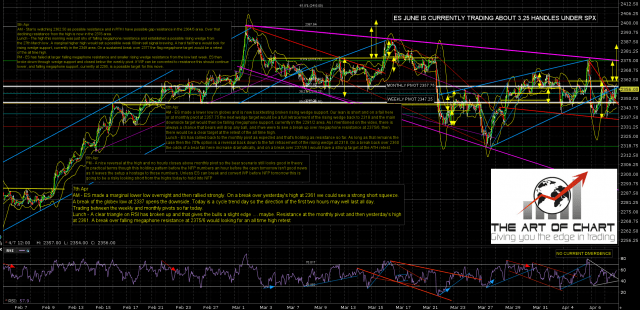

Both ES and NQ have broken over yesterday’s highs so this is the point of decision as we see whether they have formed double bottoms or bear flags. ES Jun 60min chart:

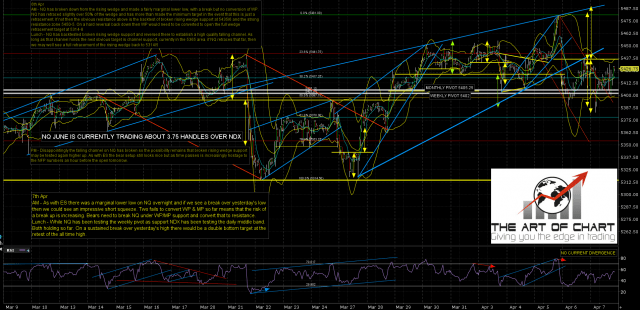

NQ Jun 60min chart:

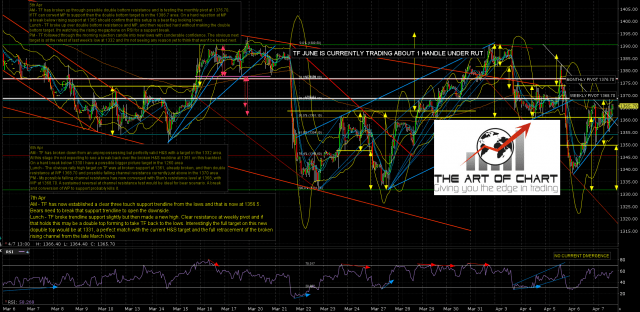

On TF the clear resistance is at the weekly pivot at 1368.70, As long as that holds this setup leans bearish. Above weekly pivot, not so much. TF Jun 60min chart:

May the fastest snail win in this so far tedious Friday tape. Everyone have a great weekend 🙂