Yesterday’s setup favored the bears on the backtest of a cluster of resistance and fibonacci levels on NDX, today’s lows on SPX and NDX have so far been marginal higher lows against the current retracement lows and that has me wondering about possible triangles forming here.

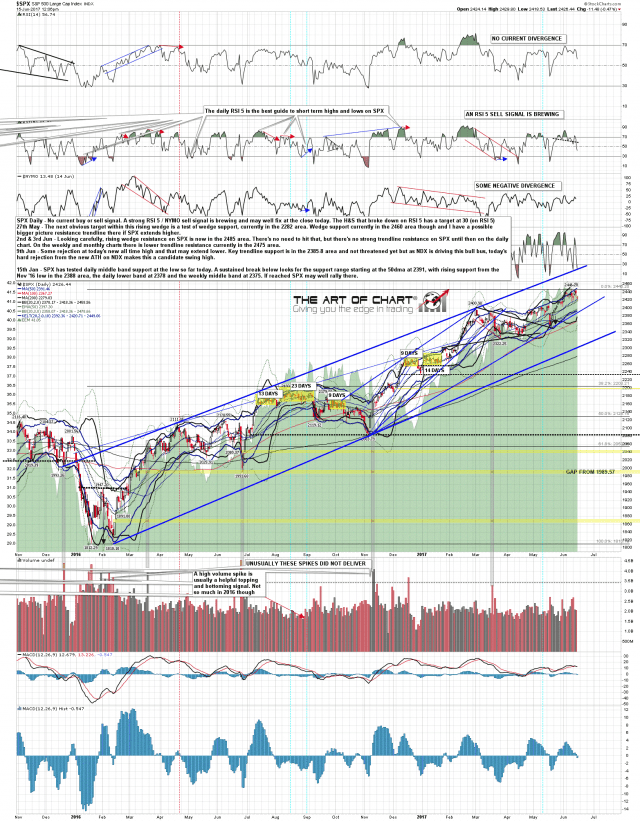

There is now a very decent looking double top setup on SPX that on a sustained break below 2415.70 would look for 2384/5. That is in a strong support range which I have detailed in the notes on the chart. SPX daily chart:

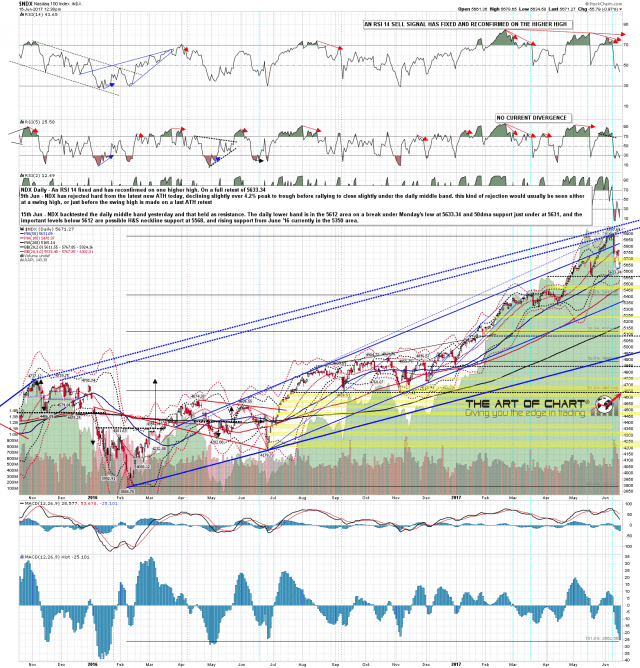

On NDX the main support level that I’m watching below is the possible H&S neckline area around 5568. As with SPX, if these support levels are reached then decent odds that we see significant rallies there. NDX daily chart:

The ES and NQ futures charts below done were before the RTH open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

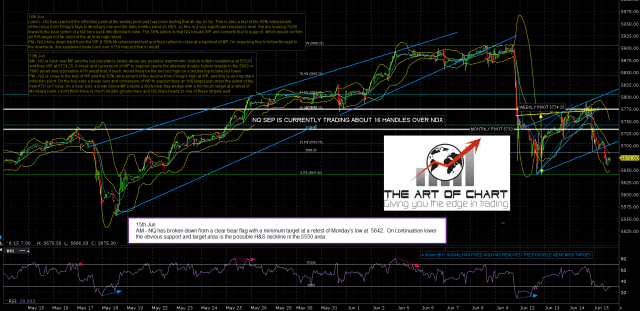

The double top setup very similar on ES. I’ve mentioned the increased risk due to yesterday’s marginal lower high against the ATH that a bull flag may be forming here rather than a double top. The weekly pivot at 2428 is an important level for direction today and, if broken, I have a short term double bottom target from the lows this morning at 2433.75. ES Sep 60min chart:

I mentioned on NQ that the bear flag wedge turned channel that broke down overnight has a strong minimum target at the full retest of Monday’s low at 5642. That minimum target is highly likely to be tested and hasn’t been tested yet. Likely unfinished business below. NQ Sep 60min chart:

Watching important resistance at the weekly pivot at 1412.90. TF Sep 60min chart:

I think this reversal has legs, but the buy the dippers have had everything their own way for so long now that the decline is likely to start off being very spiky, with buy the dippers jumping on every possible long opportunity until they become discouraged. It should be fun to daytrade though, and this move should set up a larger next move coming soon that should be less spiky.