Umm, where is everybody? Is this market seriously boring everyone to death? It would seem so. I never thought summer was such a huge draw for people.

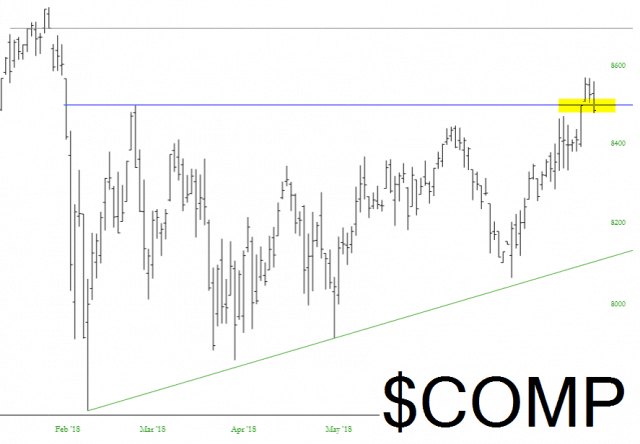

Anyway, I’m back home now, and I thought I’d thumb through some index charts, since Monday gave us a bit of “bullish breakdown”. Starting with the Dow 65 Composite, you can see in the tinted zone how the breakout (quite pronounced last Thursday) has been a total washout. What I’d love to see, of course, is continued weakness toward that supporting trendline. The “gap up” is now squashed.

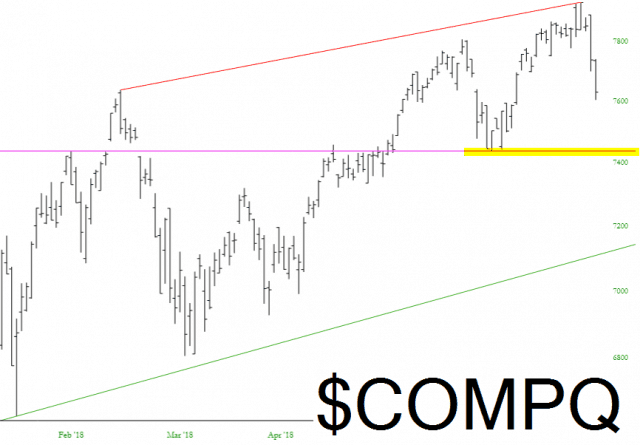

In spite of all the damage tech has been taking (FB, TWTR, NFLX, IQ), the NASDAQ Composite is actually far healthier than most other indexes. It’s going to take a lot more damage (a break of the tinted zone) to get things in gear. Until then, the selling is simply making things Insanely Expensive instead of Really Insanely Expensive.

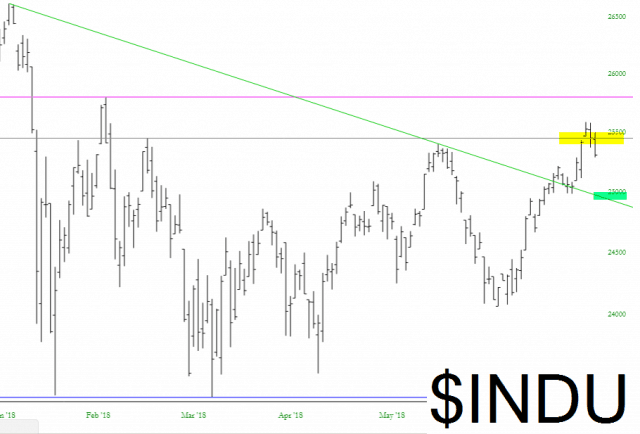

The Dow Industrials, not surprisingly, has a similar bullish breakout failure that the overall Composite had.

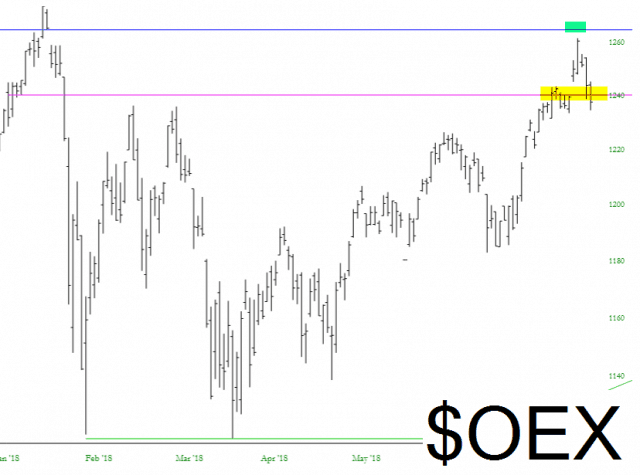

Same deal with the S&P 100, although this also has the interesting trait of trying (but failing) to get past its failure gap from early this year. It got very close (green tint) but flopped right over.

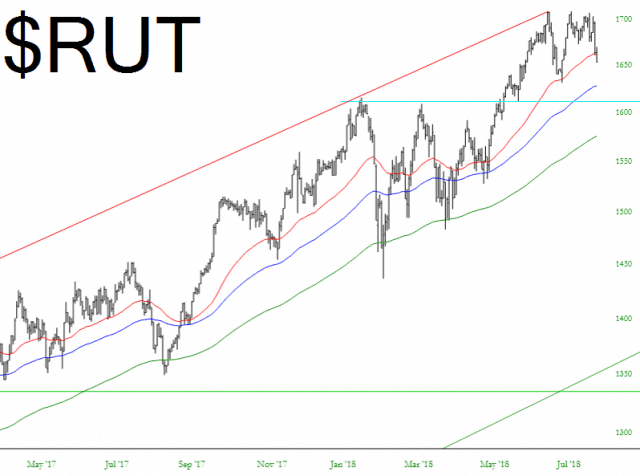

In a fashion similar to the NASDAQ, the small caps are still rock solid, with the moving averages cleanly uptrending.

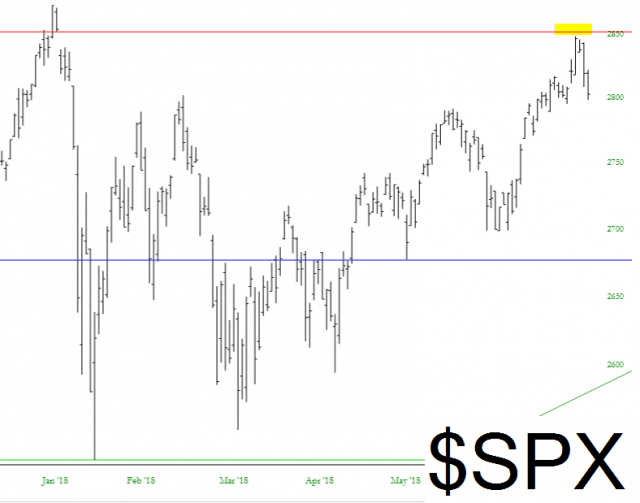

And here we have the S&P 500 which, like its little brother the S&P 100, tried (but failed) to close its gap from early 2018. The uptrend is quite obviously still firmly intact.

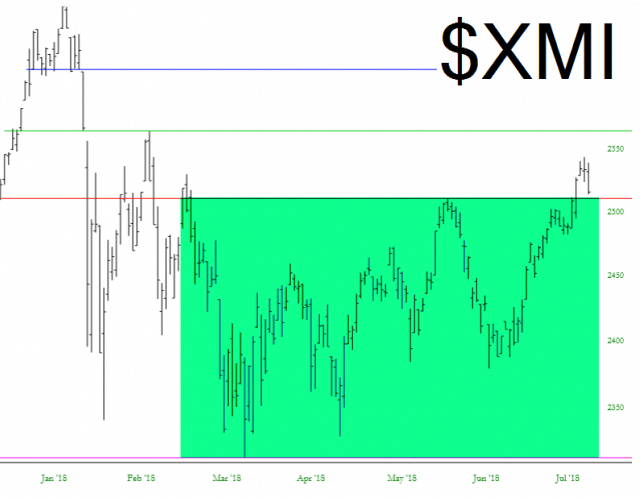

Lastly is the Major market Index, which is quite bullish. We’re going to need to re-enter the green tint, which is the basing area, in order to undo this setup. Fingers crossed!