Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Post-Earnings Spasmodics

Gold/Silver Ratio: Rising for a Month Now

Well, look who is sporting a bullish looking pattern on its daily chart. It’s probably NFTRH‘s most watched indicator outside of the T Bond Continuum.

As you can see, a rising Gold/Silver ratio (GSR) attended the market stock market disturbances in February and March and a declining GSR has attended the relief, i.e. the expected ‘top-test’ by the S&P 500 that has ground on since roughly the same time that GSR topped in late March.

The GSR has spent a lot of the post-financial crisis era in dysfunction mode, but so far in 2018 it is working as we’d normally expect; it rises with market liquidity contraction and declines with risk ‘on’ and an absence of liquidity events.

So, is that indeed a bull pattern? Can we assign such TA to a ratio as opposed to a stock or an index? Valid questions, but all things being equal stock and/or commodity bulls would probably rather not see a pattern like that. What can’t be argued is that gold’s ratio to silver has been increasing for a month now. (more…)

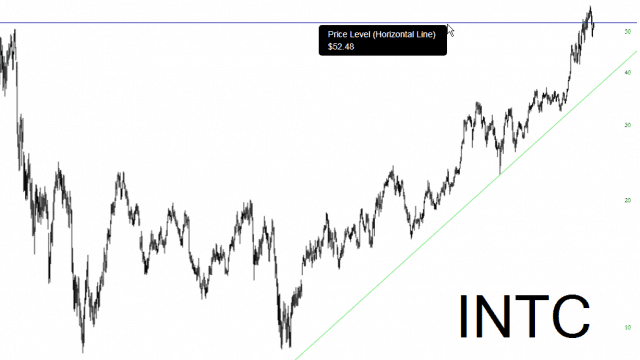

Countdown to Intel

Next Thursday afternoon is going to be a monster for earnings reports – Amazon and Intel. Obviously the Friday following will be a big mover in one direction or another (although, give the past 9 years, I can only assume New Lifetime Highs).

I wanted to share Intel in particular since it has a recent gap at 52.48. If it remains below this, we’ve got a failed bullish breakout, which is significant, because otherwise this is a hell of a gorgeous bullish setup. Indeed, if the price seals up that gap and pushes above it again (which won’t take much doing), Intel could have years of gains ahead of it.