Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Notifications!

Greetings from (once again) the beautiful wine country of Northern California.

I wanted to mention again a survey a Sloper asked me to post – – please click here to do it – – it has to do with how people follow stock trends. We’re puzzled, because the last time we posted a survey, he got hundreds of responses. I posted his newest survey recently, and he didn’t get a single response, which suggests to me I screwed up somehow. Anyway, please take the time to fill it out; it’s just a survey.

Anyway – – a rather dry topic, but important, so let me do a post on it – – tucked away in a little corner of Slope is a screen that lets you control your email notifications. To get to it, click here and you’ll see something like this:

The reason I mention this it because I want you to make sure you have set yours to your liking. Some folks in the past few weeks mentioned problems with theirs, and we got this feature working shipshape. I just wanted to bring it to your attention so you can double-check your own choices.

Monday, Monday

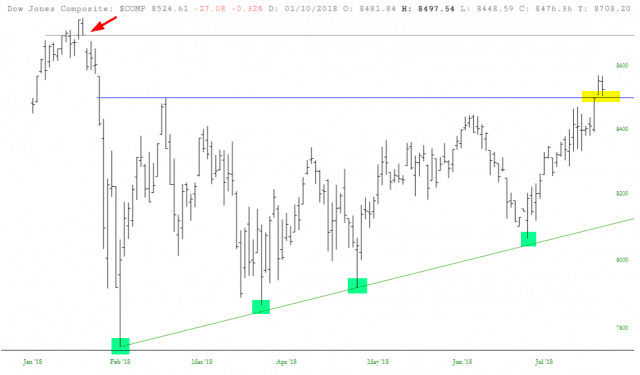

Last week was a terribly interesting one in index-land. On the one hand, there are bullish formations everywhere, and quite well-formed ones too, which seemed at the cusp of an amazing breakout. On the other hand, things kind of sputtered on Friday. Thus, the week ahead, particularly with AAPL reporting on Tuesday, is going to be especially important.

Below is the Dow Jones Composite, whose price gap I’ve marked with an arrow. It hasn’t reached that level yet, although it did break above an important horizontal level. After the gap up (Thursday), it retracted that strength (Friday), so it needs to hold above that line, tinted in yellow, to secure this breakout. Otherwise, it’s a failed bullish breakout.