Last week was a terribly interesting one in index-land. On the one hand, there are bullish formations everywhere, and quite well-formed ones too, which seemed at the cusp of an amazing breakout. On the other hand, things kind of sputtered on Friday. Thus, the week ahead, particularly with AAPL reporting on Tuesday, is going to be especially important.

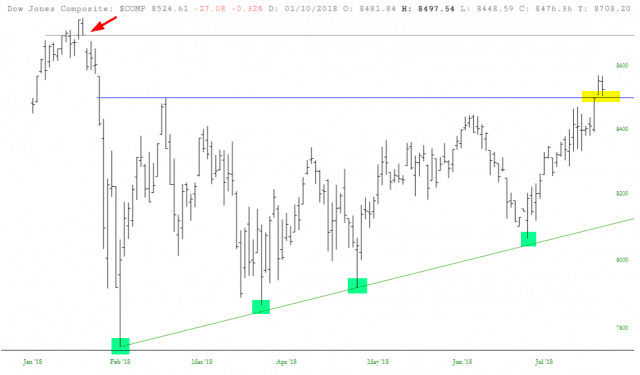

Below is the Dow Jones Composite, whose price gap I’ve marked with an arrow. It hasn’t reached that level yet, although it did break above an important horizontal level. After the gap up (Thursday), it retracted that strength (Friday), so it needs to hold above that line, tinted in yellow, to secure this breakout. Otherwise, it’s a failed bullish breakout.

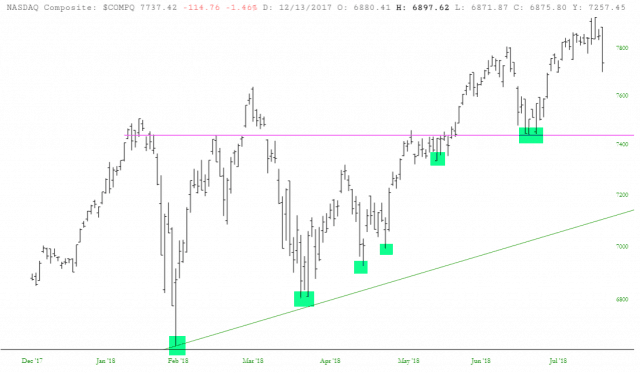

The NASDAQ is clearly still in an uptrend, and it’s going to take a hell of a lot more damage than just FB and INTC to break it. The green tints show the higher lows, and it’s going to have to take out that horizontal to break this uptrend.

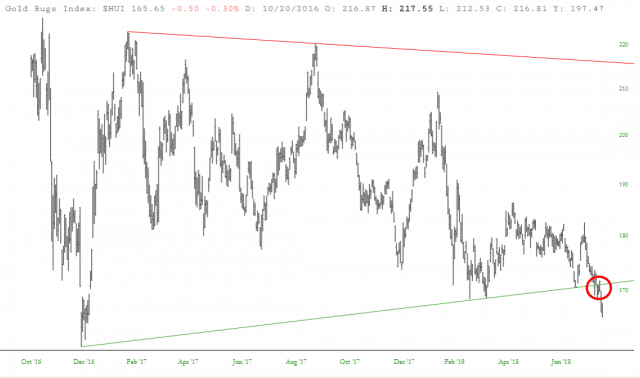

Stepping away from equities for a moment, I just want to say once again how deathly ill I believe the entire precious metals sector is. All the major support lines are busted.

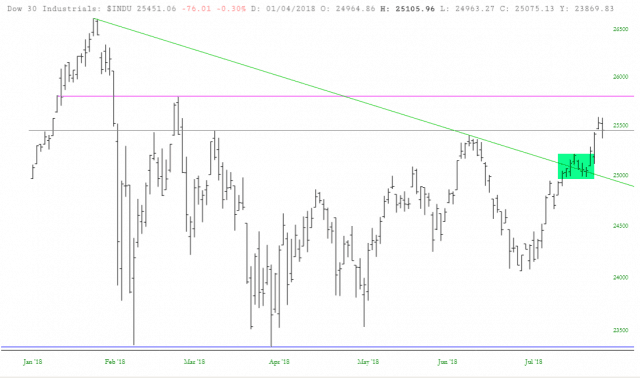

The Dow 30 had an important breakout a couple of weeks ago. If it pushes above that magenta horizontal, the bears are screwed even worse than they have been the past nine years.

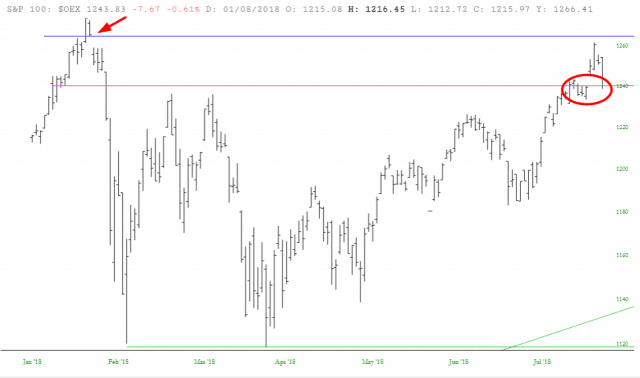

But, as I implied earlier, there are signs of wavering. The S&P 100 index got very close to its gap (arrow) and then retreated. If it can break beneath that cluster of activity I’ve circled, it’s in trouble.

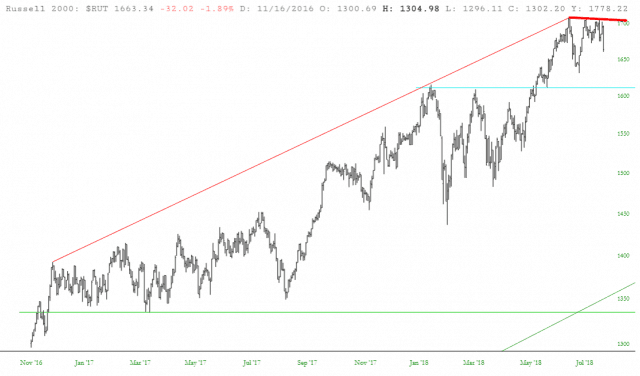

The Russell 2000 is also in a gargantuan uptrend, although it has stalled out somewhat the past month. Here again, it’s going to take some SERIOUS damage to reverse this, which would specifically be a drop below that horizontal below.

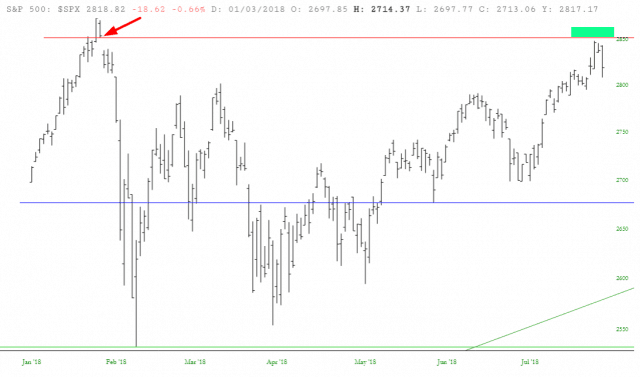

Lastly, here’s the Big Kahuna – – the S&P 500 index – – which has a very important price gap marked with an arrow. Prices were repelled this week from this level (green tint). The bulls need a breakout to give this ascending market a new lease on life.