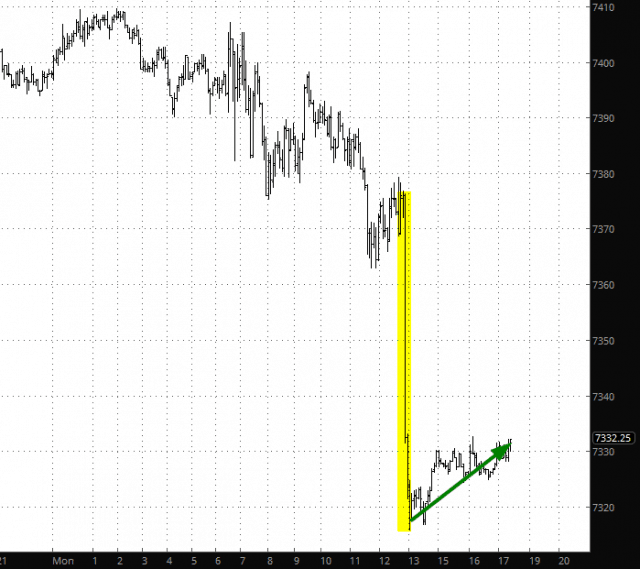

As I mentioned on my Twitter feed, some folks are going to get a little confused (and misled) by the NQ since there’s all this chatter about Netflix’s plunge and yet the NQ is bright green (at least as of this writing). What they’re missing is that, in the few minutes between the close of the regular session and the close of the GLOBEX, the NQ went plunge-a-roony. When the new “day” began, everything is zeroed out, of course, and so the gain they see on the NQ is merely a fractional recapture of the loss it had earlier (tinted below in yellow).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

It Wasn’t Supposed to Be Like This

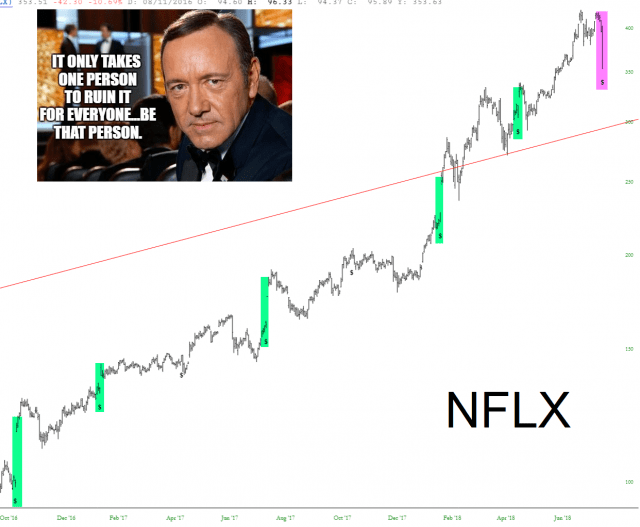

It is understandable why people would be long Netflix going into earnings. (You can press Ctrl-E in SlopeCharts to see all historical earnings events). After all, NFLX reliably vaults higher every time they announce. This trend continued until……….it didn’t. As I said earlier, give me this same result with Amazon in 10 days, and this goose is cooked.

But the P/E Was Only 260!!!!!!!

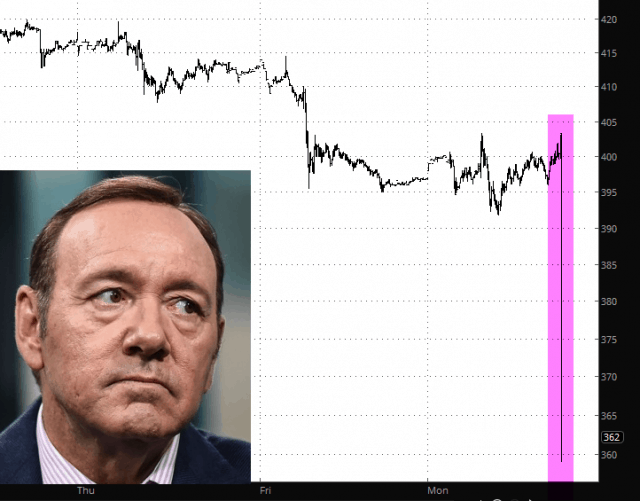

As I have no position at all in Netflix, I feel within my rights to respond to the stock getting the Kevin Spacey treatment after hours – har de har har har. Tee hee hee. Ho ho ho.

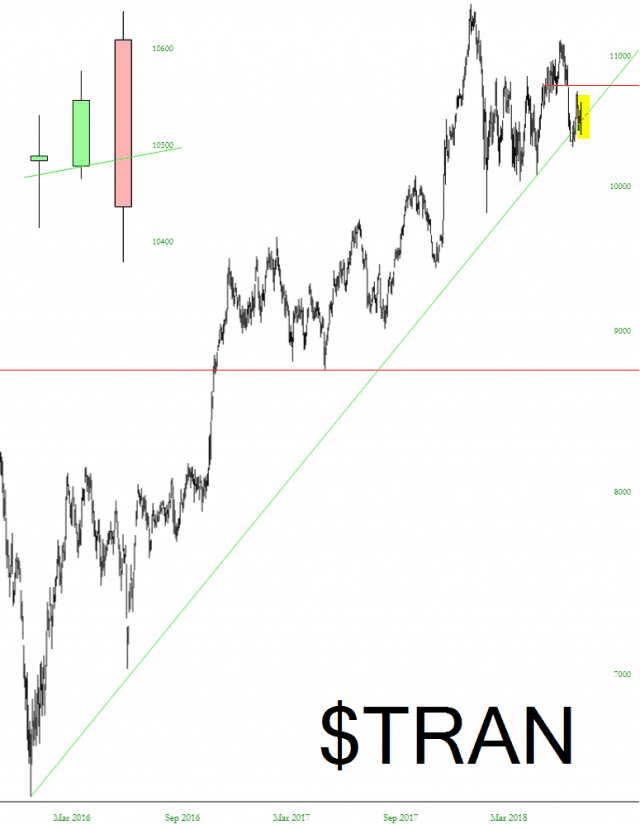

Transports Are Becoming Derailed

Commodities Breakdown

Between weakness in gold (which is nearing its 7th consecutive year of its own private bear market) and an oil market that’s down over 4% so far today, commodities continue to tumble away from their reversal pattern. I’m not expecting a hard fall, but things certainly seem poised to continue melting away for weeks to come.