I hope I’m not making too much of this, but honestly, virtual trading has been profoundly eye-opening:

You see, a big part of the reason I created the virtual trading system in the first place was to get myself out of a lifelong trading rut. I wanted to learn sophisticated options strategies like the big boys and really do things right.

Well, that never really took hold for me, since I just didn’t “click” with the thinking of an options trader. So I just reverted to what I had always done – – buying puts on equities – – with the only “twist” being that I made the bets quite conservative (the expirations were many months out, and the strikes were in the money).

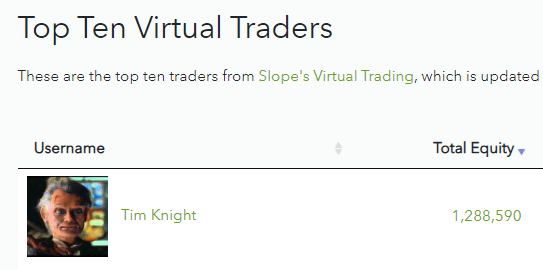

Watching paint dry would have been as interesting. Even when the market had a big move, my positions would barely budge. It isn’t hard to understand why: the conservative nature of these positions made them little different than simply having a small equity stake in the underlying stock. I tumbled off the Top Ten list as my positions just sat there with grass growing around them.

Two or three weeks ago I decided on an utterly different tack, and I focused on very short-term options with very liquid instruments such as SPY and QQQ. The results speak for themselves. Now, if I had bought an ungodly number of puts and the Dow had just crashed 7,000 points (ha!) this would be just dumb luck, and there would be no lesson learned. However, there has been no crash at all. Sure, we’re a few percentage points below the highest prices in human history, but this wasn’t just dumb luck.

As I’ve mentioned, I took this lesson to heart and have embraced the same – – dare I say it?? – – YOLO disposition in my real-life account. I’m afraid my shared Put Options watch list has become quite dull (I might even un-publish it) since I think I’m just going to stick to the short-term super-liquid stuff. For those premium members who do enjoy my watch lists, I would tell you that my Bear Pen is still very actively managed and has, in my opinion, the best short setups.