I come to you from the Delta Sky Club with a head hanging low, burdened by the guilt of a lack of content. I have a lengthy plane flight ahead where I can stockpile up some posts. Let’s just take a stroll through eight major index charts while I share a few words about each. It’s a mixed bag.

We begin with the NASDAQ Composite, which is approaching important support. This lovely bit of weakness could terminate tomorrow with a huge rally for all I know (using the jobs report as an excuse). It’s also possible that we slice through the supporting line, invalidating the breakout. Take a guess what I’m hoping for.

The Dow 30 Industrials has barely had a blip lower. It, too, has a horizontal line to conquer, although it isn’t as important: it merely represents the former lifetime high before Yellen did her BTFP travesty.

The NASDAQ 100 has done something encouraging for the two bears left on the planet, which is to push to a lifetime high and then almost immediately lose it. The tech stocks have been pooing all over themselves for the past five trading days, as the likes of AAPL have gone from hero to zero. I have to wonder to myself if the tech stock insanity did its final money shot in December 2023.

Much can be said of the S&P 100, which likewise crossed into record territory, only to slip right back below its breakout level. Huzzah!

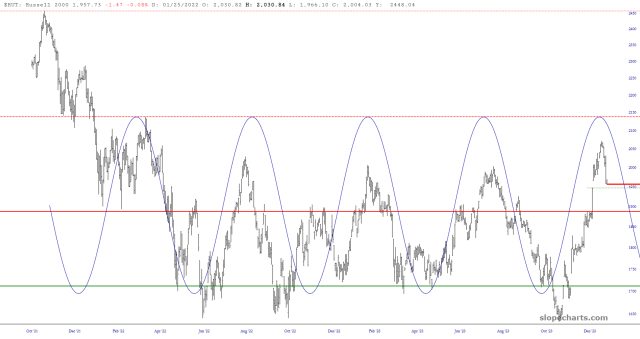

Of course, my fascination with Russell 2000 is ceaseless, as the sinewave continues to play out magnificently. On Friday, let’s watch closely if we break below that price gap or not.

The semiconductor has, not surprisingly, aped the behavior of the NDX in that it pushed to never-before-seen highs and is starting to slip. As I keep saying, the fact that James “check out my hair!” Altucher is hawking this stuff provides me even more encouragement than if Cramer and Gartman both held a special press conference and announced the same thing. Altucher is a complete bozo, in my opinion, and historically has signaled a top tick. He also has this creepy combination of aw-shucks modesty coupled with megalomaniacal tendencies. What a fuckin’ weirdo. Anyway.

The S&P 500 just couldn’t cut it. Try though it might, it failed to make a new lifetime high, so the record from January 2022 remains!

We close with the Utilities, which continues to have the most oh-my-God amazing diamond pattern I’ve seen in my life. I have high hopes for this beast!