As valuable as it is to recognize patterns, it is just as valuable to recognize when price action exits a permissible zone. Sometimes this can be in the form of prices just “exiting stage left” from a formation, and other times the pattern will be complete and behaving itself and then suddenly do a 180-degree turn. Here are three examples of topping patterns that DID look good but defied expectations (and should have been aborted when the violation took place).

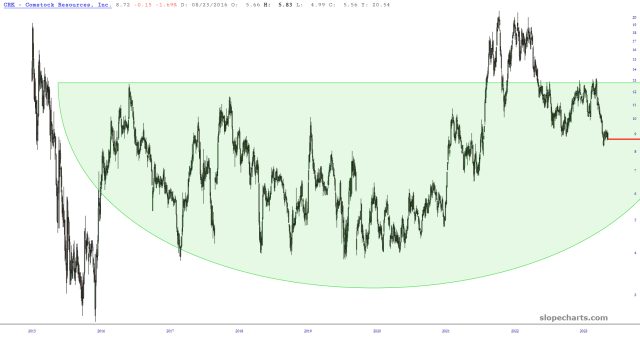

This is a two-edged sword. Bearish and bullish patterns can both fail. Below, for instance, is a rounded bottom pattern which blasted out of its base, only to slump right back into it after a few weeks in gains-ville.