Two Visions Of America’s Future

On X yesterday, America 2100 shared a thread contrasting two different versions of retail: membership-only stores, as represented by Costco Wholesale Corporation (COST) and Walmart Inc.‘s (WMT) Sam’s Club, versus open-to-all CVS Health Corporation (CVS) and Walgreens Boots Alliance, Inc.‘s (WBA) Walgreens. They made the point that only one of those models works well when there’s low social trust.

Walgreens Versus Costco

The contrast between the two stocks over the last year has been extraordinary–COST up more than 60%, and WBA down more than 60%.

What If Costco Is Forced To Be Inclusive?

In a quote post of America 2100’s thread, author Auron MacIntyre raised that question.

Did the federal government’s Equal Employment Opportunity Commission (EEOC) really sue gas stations for using criminal background checks to screen employees? Yes, they did. Via The Washington Examiner earlier this year:

Gas station chain Sheetz has been sued for conducting criminal background checks on its job applicants.

The lawsuit was filed by the Equal Employment Opportunity Commission and lists Sheetz, Inc.; Sheetz Distribution Services, LLC; and CLI Transport, LP as the defendants. The EEOC says that Sheetz has disproportionately screened out black, Native American, Alaska Native, and multiracial applicants from its hiring process due to the chain not hiring applicants with criminal conviction records.

It sounds like MacIntyre’s warning may eventually come to pass if current political trends continue in the U.S. With that in mind, let’s look at hedging Costco past November’s election.

Downside Protection For Costco

The 1 minute TikTok below shows a couple of ways of hedging Costco beyond the November election, using the Portfolio Armor iPhone app.

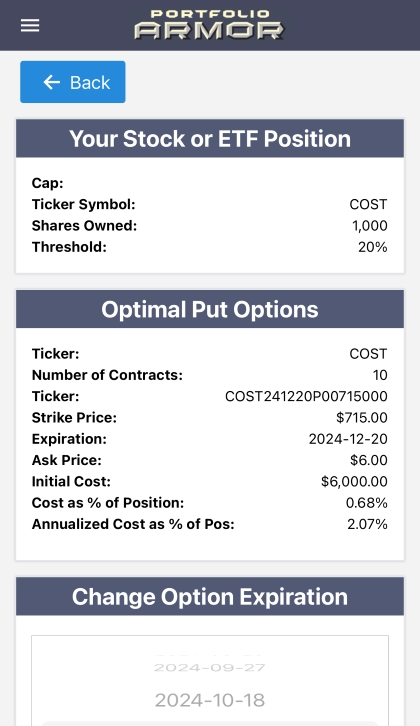

Here’s a screen capture of the first hedge shown there, the optimal puts to hedge 1,000 shares of COST against a greater-than-20% drop by late December.

As you can see there, the hedging cost was 0.68% of position value (calculated conservatively, using the ask price of the puts). The optimal collar hedge shown in the video had a negative net cost, meaning you would have collected a net credit if you opened that hedge.

You can download the Portfolio Armor iPhone app here, or by aiming your iPhone camera at the QR code below.

If you’d like to stay in touch

You can follow America 2100 on X here, and visit their site here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).

Bonus Charts from Tim: Thanks for the post, Dave! Here are some SlopeCharts to supplement this excellent article: