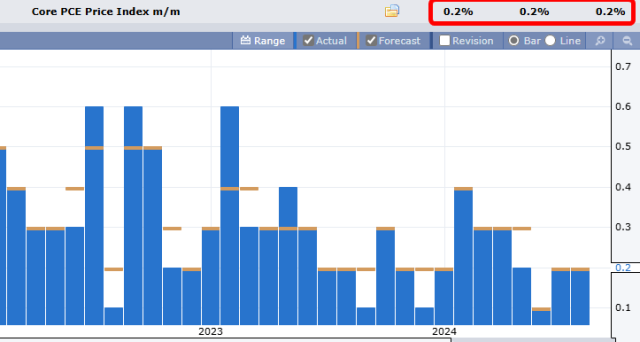

Well, that was a non-event. The Fed’s favorite inflation data came out, and the previous data matched the forecast matched the actual number. Zero point two percent across the board. Because, ya know, inflation is only 2.4% a year. You can see it in the bills you pay. You betcha.

Whatever pleasure or relief this would have provided the bulls was already built into the all-night-long stock rise. As I’m typing these words, the /ES is up 0.3% (hey, kinda like the CPE!) after having drifted higher for No Particular Reason ™ since yesterday’s mini-plunge.

The /NQ, over the past week, has been an interesting critter. Last Friday, Powell’s Pointless Pivot caused some brief turgidity (left rounded rectangle) but, as even the partially sighted can plain tell, it’s been pretty much a daily series of Lower Highs. Not exactly the stuff that bulls want to see.

The one stinker for me at the moment is DELL, against which I went into a medium-sized position of January puts yesterday. It’s up about 6% pre-market, although even with that it’ll have not violated its pattern (although just barely). It’s a bit touch ‘n’ go, so we’ll see if it survives the open.