After two days of selling for the entire year (August 1-2), things are back to normal, which means:

(a) the market goes up every day, irrespective of true value

(b) when it isn’t busy organizing Klan rallies, ZH is spouting whatever Goldman Sachs tells them to say

(c) target prices are establishing predicated on every citizen buying at least $5,000 worth of product from Nvidia.

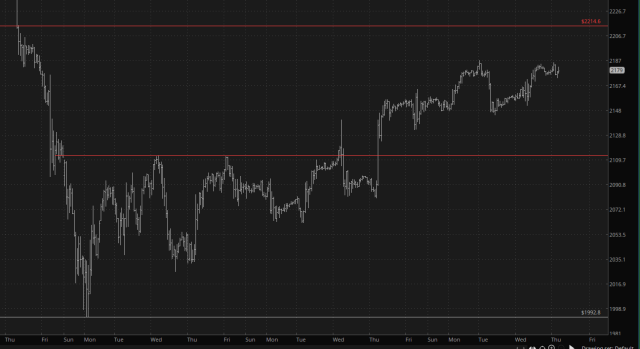

Here’s what the /ES has been up to ever since almost every brokerage decided to go offline and become inaccessible for trading on August 5th:

To which there is only one response:

The small caps, bless ’em, are vasty more contained and predictable. The red line at the top of the chart is a very robust 23.6% Fibonacci retracement, and I think /RTY is going to stay nicely inside its box.

One bright spot for me on this North Carolina morning is Charles Schwab, whose stock is being dumped by its biggest shareholder, TD Ameritrade, which unfortunately got caught in a huge money laundering scheme and is having to shell out billions of dollars in fines and penalties so they can have permission to keep being a bank and doing different corrupt thing instead (this is right in the bulls’ wheelhouse, after all).

So SCHW is taking a nice hit.

I’m in ten bearish positions with a decent amount of dry powder, which I’m going to save until after Powell’s pandering, patronizing, and sycophantic speech tomorrow morning from Glory Hole, Wyoming.