I read as much as I can, and I’m fairly familiar with regular contributors at the sites I visit. There’s one chap, Graham Summers, who has an outfit called Phoenix Capital Research. He has a well-earned reputation on Zerohedge for being apocalyptically bearish. He makes me look positively even-tempered in comparison. Most recently, however, there’s been a 180 degree change.

Not only does he eschew bears, he makes them look positively foolhardy. Sort of odd in light of the dozens and dozens of posts he had penned earlier with a profoundly different perspective.

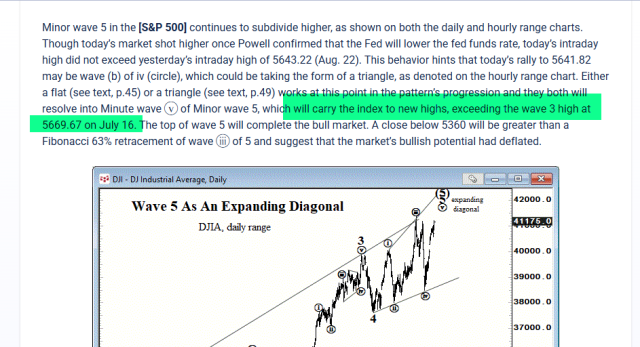

On a larger scale, there is Elliott Wave International, which has been bearish since the beginning of time. I distinctly remember in 2009 that, on the heels of 666 on the S&P, they anticipated a rally to somewhat over 900 and then, blammo, the real bear would kick in. Now, about 5,000 points later, it seems not to be the case.

Indeed, examining their most recent update from Friday afternoon, they declare (five times, no less) that we are on a course for Lifetime Highs. Life. Time. Highs.

This all leaves me a bit speechless, so I’ll leave it to some of the commenters under Graham’s post, which express my sentiment quite succinctly.