Perhaps you’re wondering what inspired me to do my trading rules list. (OK, you’re not, but I need a premise). Well, embarrassing as it is, this is what inspired it:

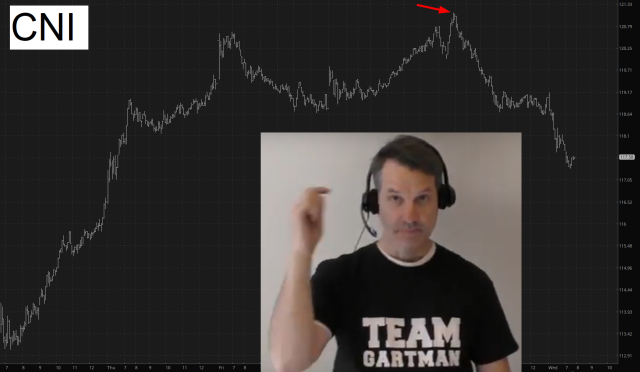

Yep. You guessed it. Yesterday morning, at the worst possible millisecond, I talked myself out of my position in CNI. I owned January puts, and I was frustrated that they kept going up, so I dumped them at a loss. Now, about twenty-four hours later, they are up over 30%, and I’m certain they’ll ultimately go much, much higher (unless I, ya know, buy them again).

In my defense, the stock was acting stronger than I wanted, but the fact is that no fundamental aspect of the setup was ruined (see Rule IV!!!!) The other problem with this is that CNI puts are very thinly traded (see rule VII!!!!). In short, my emotions pushed me out of the trade with unbelievable accuracy.

Looking at the longer-term chart, you can see how vulnerable this thing is. Like I said, I’m confident that the puts will probably wind up deep into triple digit profits, and knowing me, I’ll be looking in the rearview mirror a few times a day at this. Thus……….I just had to write down some of the aspects about which I was beating myself up.