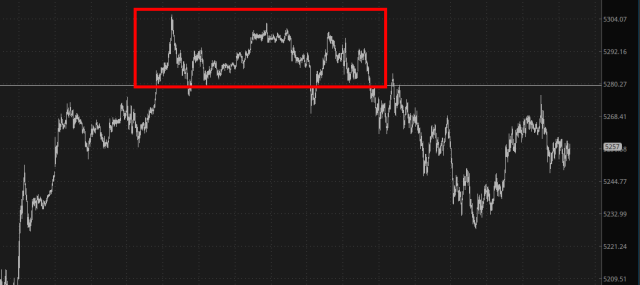

As I am typing this (I really shouldn’t have to type that each time………..) the /ES is up 35 and the /NQ is up 138, which in normal times would be a wild morning, but these days is practically tepid. Last night, we were all watching the inverted head and shoulders pattern on the /ES. The market had been beaten up badly, so it seemed pretty much a slam-dunk for the /ES to complete this IHS and, at the very least, seal up its price gap (arrow).

Instead, after completing its IHS (affirming its importance with a burst higher), it hung out there for a couple of hours before utterly rolling over. In other words, the market is so weak, it can’t even complete the most vanilla counter-trend rally.

The /NQ did a more admirable job trying to seal up its own Sunday price gap, which actually gives me some peace of mind. I really want the market to get the “prices are cheap” insanity out of its system.

I had been thinking of the recent price weakness as disturbingly like that of mid-April, which was the last time we had any selling and which, sadly, was simply a preface to an explosive move to daily lifetime highs. This time is clearly different. Back in April, the VIX didn’t even make it out of the teens. This time, the volatility move has been absolutely eye-popping. Let’s face it, the nation’s brokerage houses didn’t go into cardiac arrest for no reason.

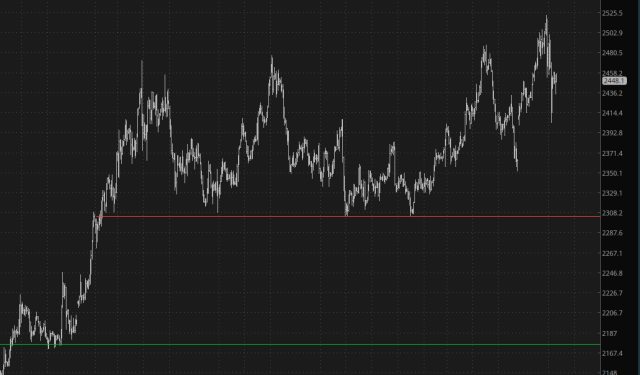

There is one thing I am finding VERY annoying, however, which is how precious metals are moving practically tick-for-tick with equities. C’mon, guys, seriously? Gold, do you REALLY confuse yourself with the common stock of Nvidia? On a longer time horizon, gold has been pretty robust (chart below), but on a minute bar basis, it is seriously just a mirror image and quite irksome.

Slope has been absolutely hitting it out of the park for weeks, which naturally makes me uneasy. As things stand now, I think anyone buying into this market is certifiably insane. The waterfall isn’t anywhere near being done, even for the medium-term. Let’s go get ’em.