Happy Thanksgiving Week, everyone. This will naturally be a quiet week overall in the markets, with the markets closed on Thursday and an early close the day before.

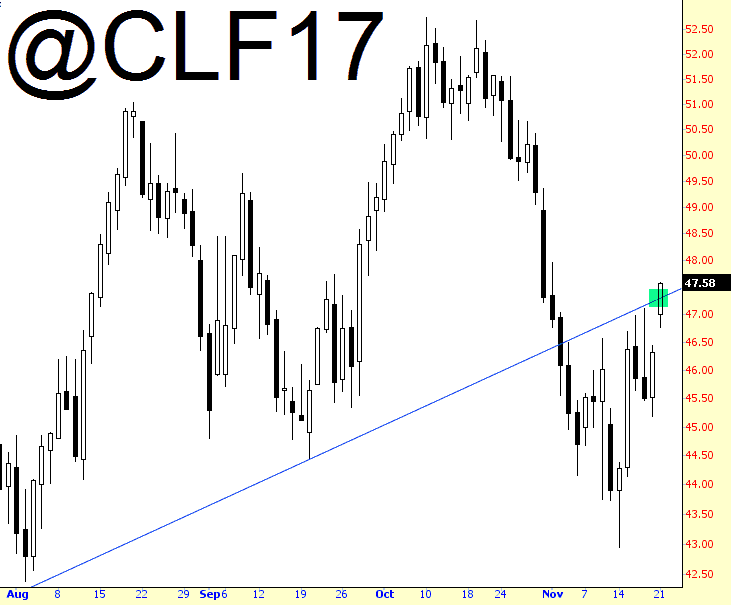

The unfortunate news for any remaining bears out there is that, first off, crude oil has broken its formerly squeaky-clean pattern. Maybe OPEC is going to succeed in pulling off a deal after all on the 30th. Here’s what the front month looks like right now, with the trend break highlighted:

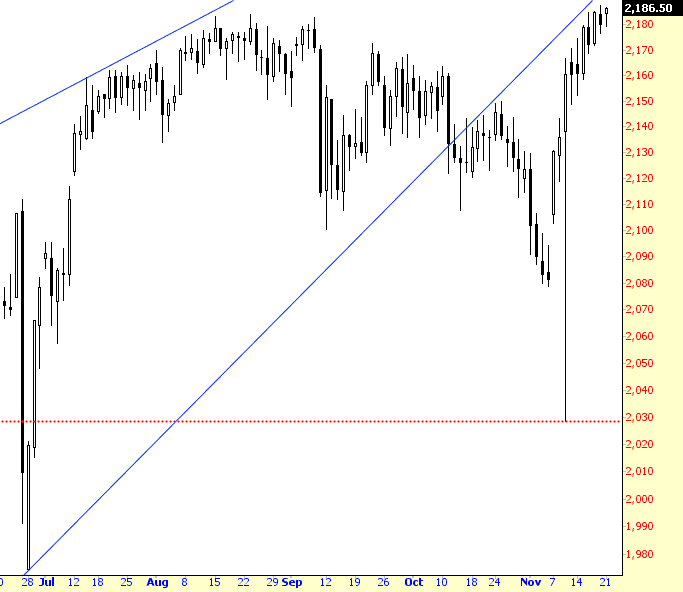

The ES continues its perpetual creep-under-the-trendline routine. Every since the (ridiculous) election night craziness, we’ve been in an orderly, systematic drift higher, day by day. I’m not sure what kind of shock event would reverse it at this point, since the market seems to be taking everything, from Trump on down, totally in stride.

Short-term, I think the US dollar rally is going to take a breather, which would mean (1) a bounce in the Euro (2) a bounce in precious metals (3) a bounce in miners. The long-term trends are still firmly in place, though, as I believe all three of these aforementioned items are headed lower in the longer-term.

I’m hosting Thanksgiving this week, so I’m going to be very occupied with family matters, but, as always, I’ll try to stay on to of Slope as best as I’m able.