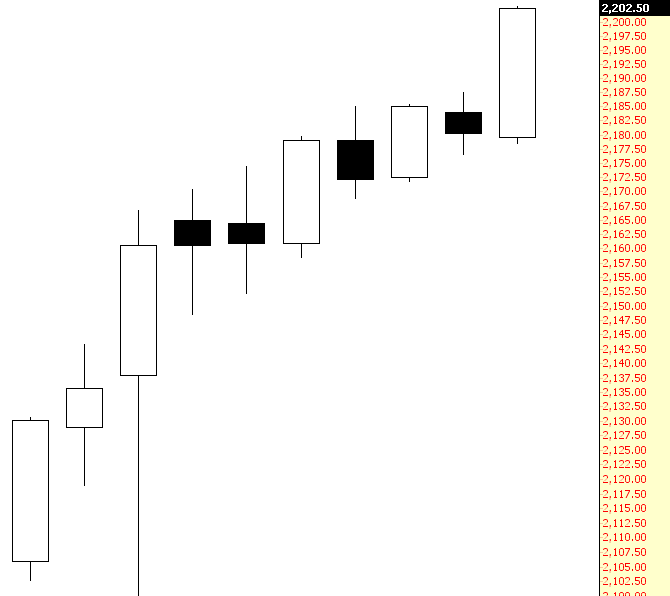

Well, I’m going to call it a day. It seems almost comic that not even two weeks ago, we were witnessing a limit-down collapse in equity markets around the world based on the prospect of a Trump victory. Who would have believed that, once those few hours of fear were shaken off, we would be in a blast-off cycle to lifetime highs across the board? It’s breathtaking (and, for the one or two bears left on the planet, nauseating). I don’t see what’s going to slow this down at any point. Dow 50,000, here we come. Here’s the ES as I say farewell.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Embracing Change

About a year ago, I got some news I really didn’t want to get: my prime broker, BTIG, was giving me the boot. I hadn’t done anything wrong, but they were nuking all their accounts less than a certain threshold, and I was below it, so, bang, I was slated to be out by the end of the year.

Big deal, you might say. There are dozens of brokers out there, and any of them can execute  stock trades. Well, yes, I know that, but when you get accustomed to a certain platform over a period of years, it’s very hard to change. I do a tremendous amount of trading, and being able to easily “flow” with my trading system is important to me. Even the little stuff – – like the fact I knew the names of the personnel at the local office, and my familiarity with all the little routines that were required each day – – was tough to abandon. I didn’t want to change.

stock trades. Well, yes, I know that, but when you get accustomed to a certain platform over a period of years, it’s very hard to change. I do a tremendous amount of trading, and being able to easily “flow” with my trading system is important to me. Even the little stuff – – like the fact I knew the names of the personnel at the local office, and my familiarity with all the little routines that were required each day – – was tough to abandon. I didn’t want to change.

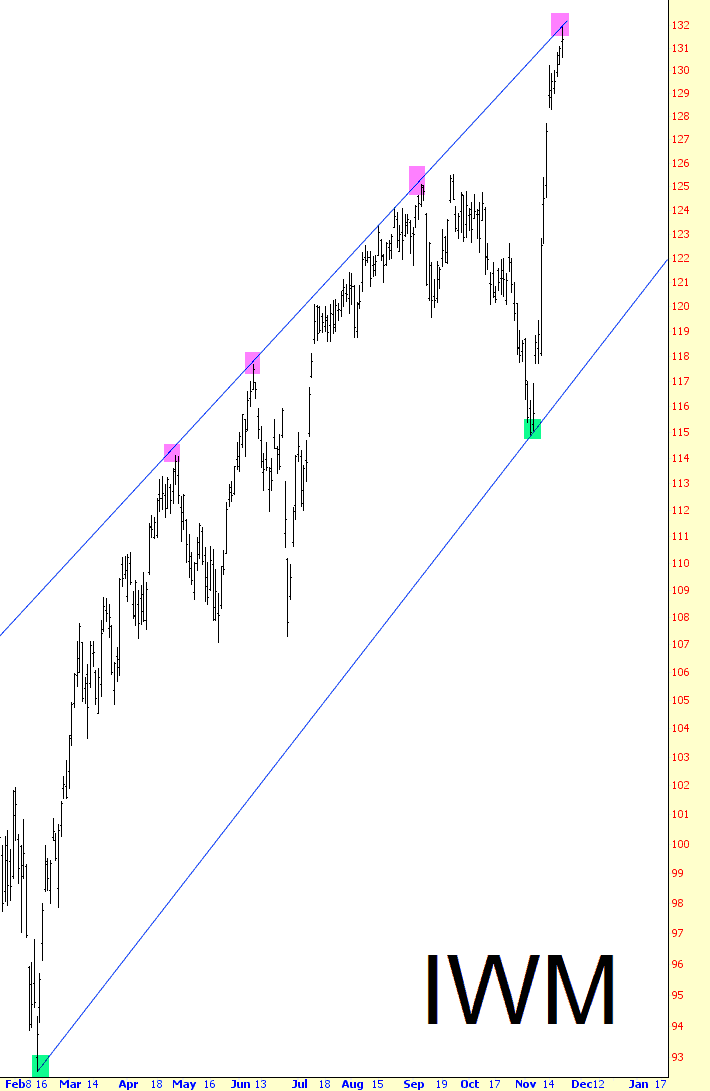

Small Caps Mashed Against Uptrend

What To Believe?

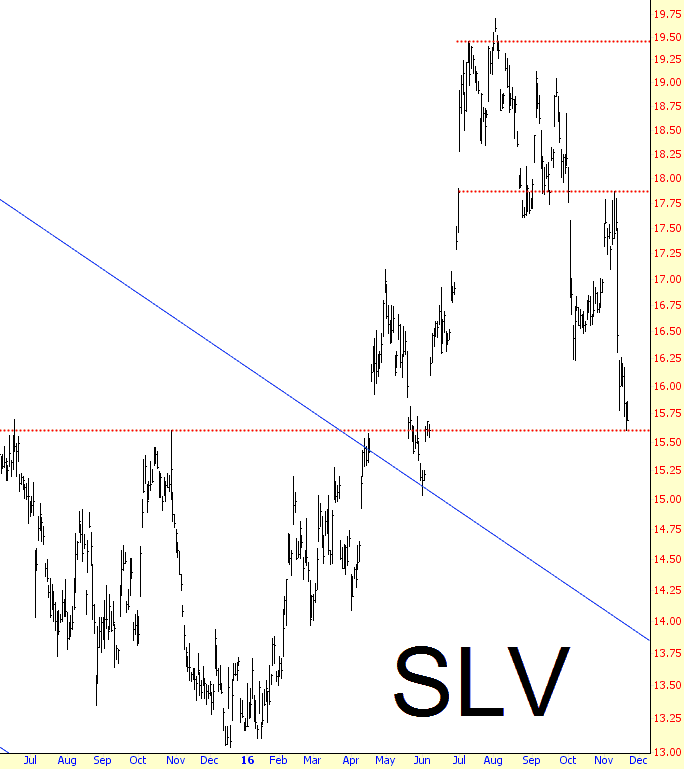

Precious metals present a conundrum at the moment. On the one hand, the metals themselves, such as silver, seem to be battered to a very “cheap” level.

Every Silver Lining Has A Cloud

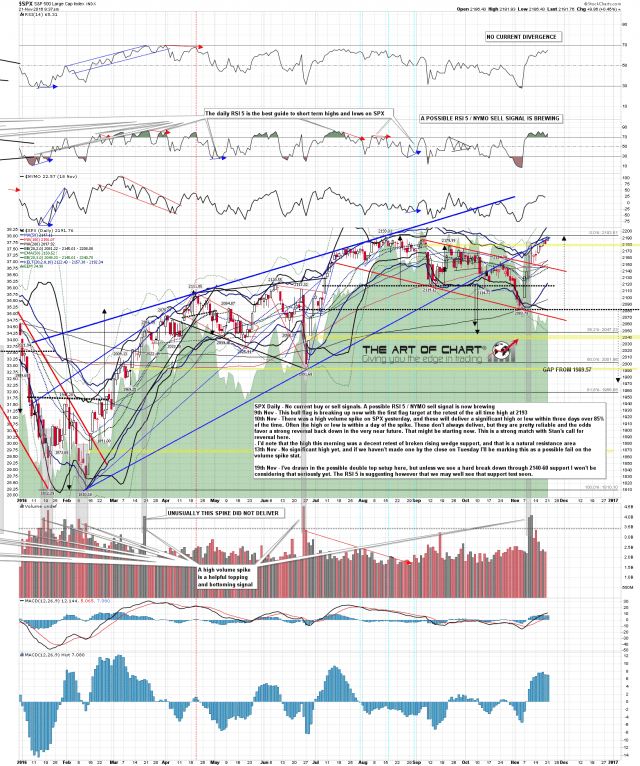

The SPX high this morning was 0.09 handles under the ATH, so I’m treating the bull flag target at that retest as made. That’s the good news for bulls and it may well be the high point of the week on SPX and RUT, though NDX is looking toppy here too, though less obviously testing serious resistance at the high this morning.

The 60min charts on all three are leaning towards seeing some well overdue retracement starting in this area, and if seen that may well dominate the rest of the week. There is also a possible RSI5 / NYMO sell signal brewing here on the SPX daily chart, which I’m watching with interest. SPX daily chart: