You know who they are; they are the ones who denied and denied the ginned up bull market in US stocks that nearly tripled under the socialist regime, circa 2009-2016. They are the ones who clung to gold well past the caution point last summer. They are (yes, it’s another snappy buzz phrase to either entertain, bore or annoy you… ) the S.O.D., AKA the Sons of Druckenmiller, AKA politically biased and newly activated market participants. Reference…

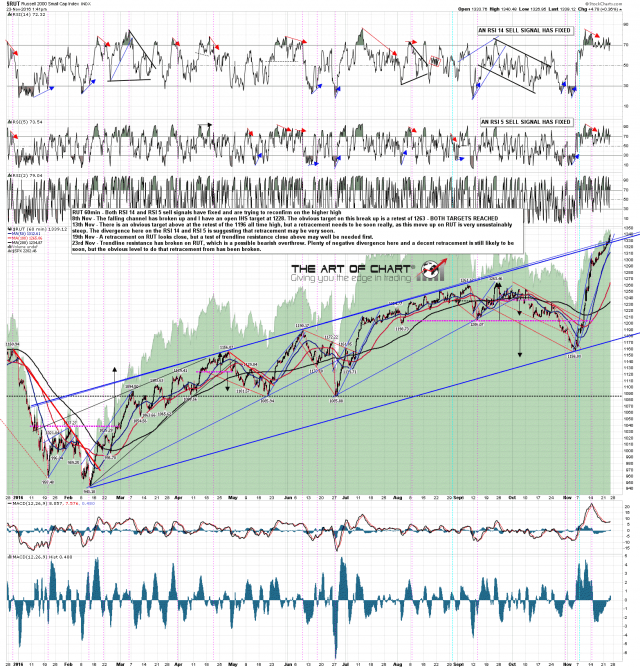

You know who they are; they are the ones who denied and denied the ginned up bull market in US stocks that nearly tripled under the socialist regime, circa 2009-2016. They are the ones who clung to gold well past the caution point last summer. They are (yes, it’s another snappy buzz phrase to either entertain, bore or annoy you… ) the S.O.D., AKA the Sons of Druckenmiller, AKA politically biased and newly activated market participants. Reference…

Druckenmiller: Get out of the stock market, own gold (this helped load the boat full of ill-fated gold bugs in the spring).

The night Trump was elected president, Stanley Druckenmiller dumped gold (this signaled the beginning of reparations to gold’s sentiment profile). He also became very bullish on the stock market; go figure.