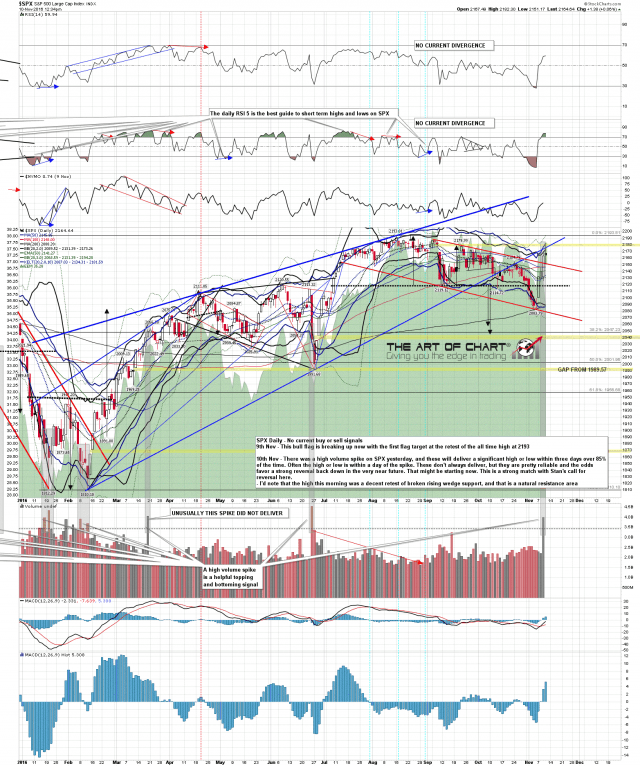

HUI has been targeting as low as the gap at the 180 area for months now, since losing the 50 day averages. I may have shown this chart once publicly, can’t remember for sure. But it is one of a few that we’ve used to manage the process of a correction that was well earned (please, save the conspiracy theories).