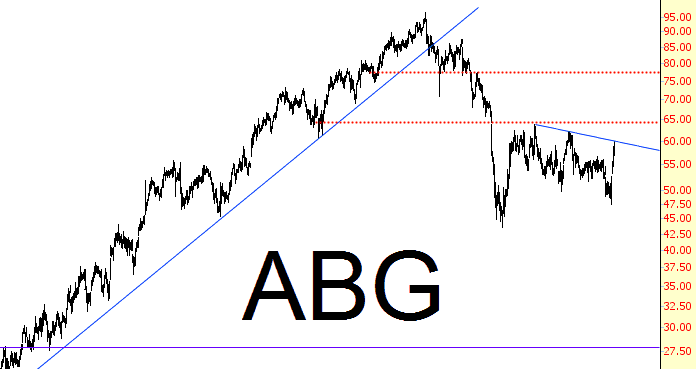

The market is still in the throes of this unexpected (and, to me, inexplicable) Trump-gasm, but to my eyes are there far, far better opportunities on the short side of the market than the long. Here are 7 of my current 45 short positions that I’d like to share with you:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

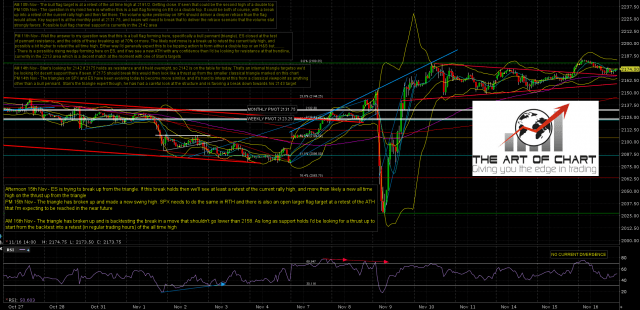

Backtesting the Triangle

It’s been a boring day, but what has been happening is that the triangle / bull pennant that broke up yesterday is doing the usual triangle sequence of backtesting the break before the triangle thrust up. After the triangle thrust up ends of course it’s then 90%+ probable that the thrust is fully retraced back to this backtest low.

So is the backtest finished? Maybe, though normally it would go a bit deeper. It may need a little lower before the triangle thrust begins. When the thrust does begin I’d be expecting to see at least a full retest of the all time high on SPX. ES Dec 60min chart:

Harry Boxer’s Charts of the Day

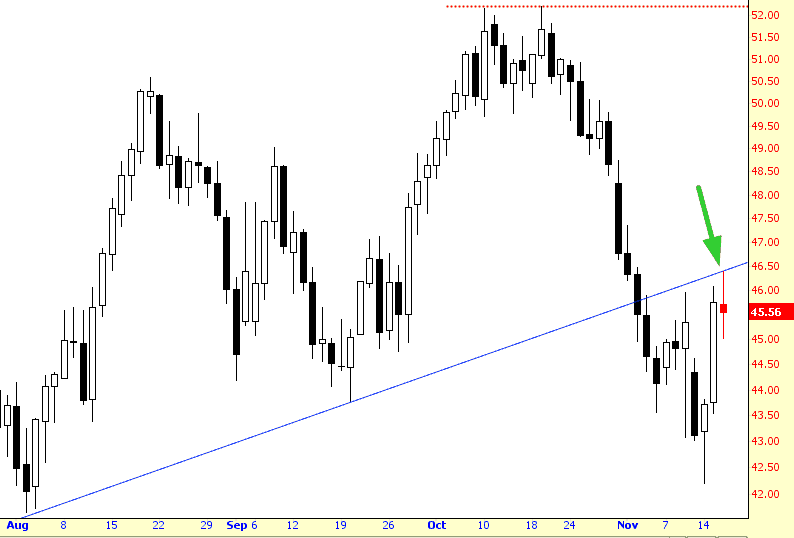

Dead Nuts On

Crude oil is acting picture-perfect. As I specifically mentioned Monday, I believed it might rally to the underbelly of its trendline, and this morning, with yet another goofy rumor from Russia, crude oil soared……….PERFECTLY touching its trendline, right to the pixel. Huzzah!

So I am VERY enthusiastic about shorting energy stocks at present levels (and, as a bonus, Gartman turned bullish on oil yesterday, God bless him).