It occurs to me that in public writing I tend to bludgeon people with macro fundamentals (like gold vs. positively correlated markets, yield relationships and even confidence in global policy makers), market indicators (VIX, Equity Put/Call, Gold-Silver ratio, Sentiment, Participation, etc.) and other views beneath the surface of things. So much so that I sometimes forget that people might like to see simple nominal charting as a frame of reference.

We update charts like these every week in NFTRH, but I have done relatively few for public review. So here it is, a simple weekly chart update of various markets, with very limited commentary interference from me.

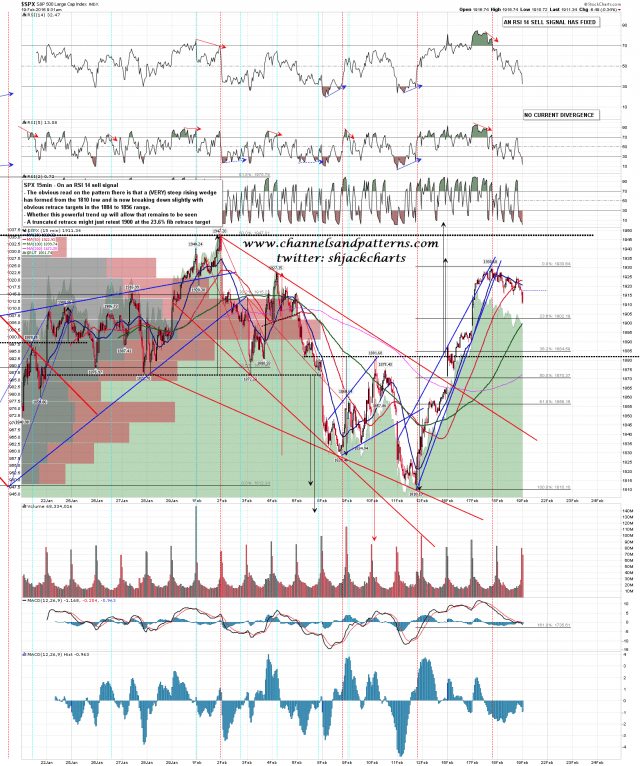

US Stock Market (more…)