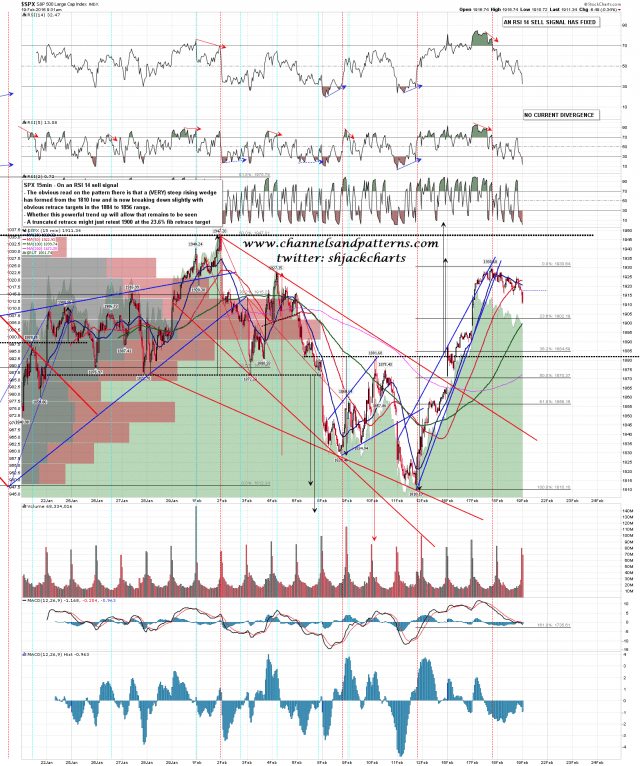

I was really wondering on Wednesday whether the normal rules for patterns and retracements had been temporarily suspended for this move, but yesterday’s rising wedges broke down and we are seeing retracements now. The minimum target for this move on SPX should be the 23.6% fib retrace at 1902 (tested at the open) and I would normally expect SPX to at least test the 38.2% fib retrace area around 1885. I’m doubtful about SPX getting lower than 1885 but it is a cycle trend day today so in the event that we trend down the other fib retrace targets are in the 1870 and 1856 areas. SPX 15min chart:

The obvious retracement target on ES is the 38.2% fib retrace at 1884. the 23% target at 1903 has already been broken at the open. ES Mar 60min chart:

I’m expecting a retracement and then continuation higher high, though I could, as ever, be mistaken. That continuation upwards may not start happen today with up volume a tiny 10% at the open. If that persists we may well see a trend down day. I would warn that there are no obvious topping patterns on either SPX or ES here, so we could see one form. That could involve a retest of the highs this week of course. Everyone have a great weekend. 🙂