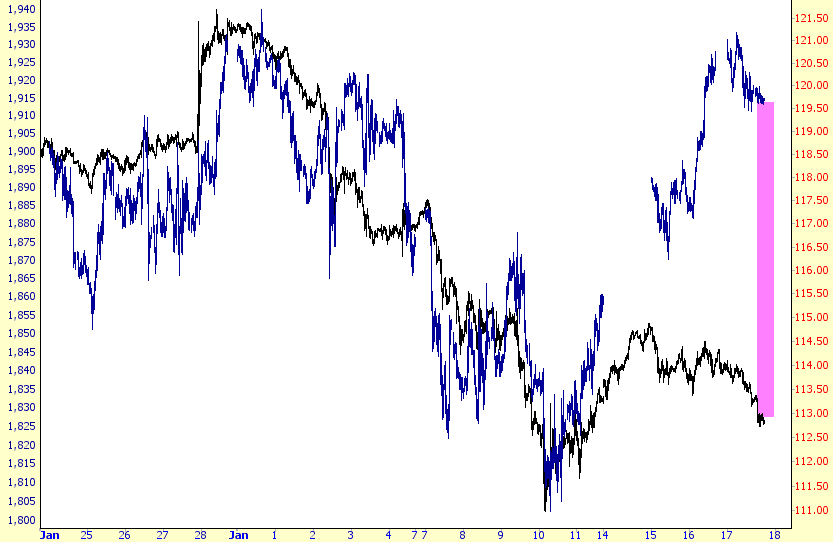

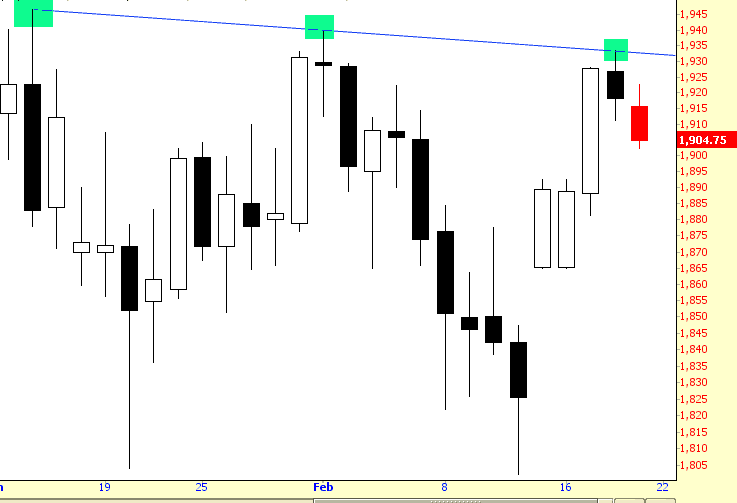

I never want to tempt the trading gods with hubris, but sheesh, that seemed a little too obvious, didn’t it? On Wednesday, when Slope was littered with individuals calling for the ES to go – – and I quote – – “straight up” from its already lofty heights, I took a look at the simple chart imaginable (the ES itself) and observed the following trendline:

Of course, those last two bars weren’t there yet, but I took some small comfort (which I needed badly) in seeing that we were approaching what appeared to be another lower high, and that a reversal was at hand. Mercifully, so far, that’s precisely what has happened, with crude oil extending its slippery hand to help.