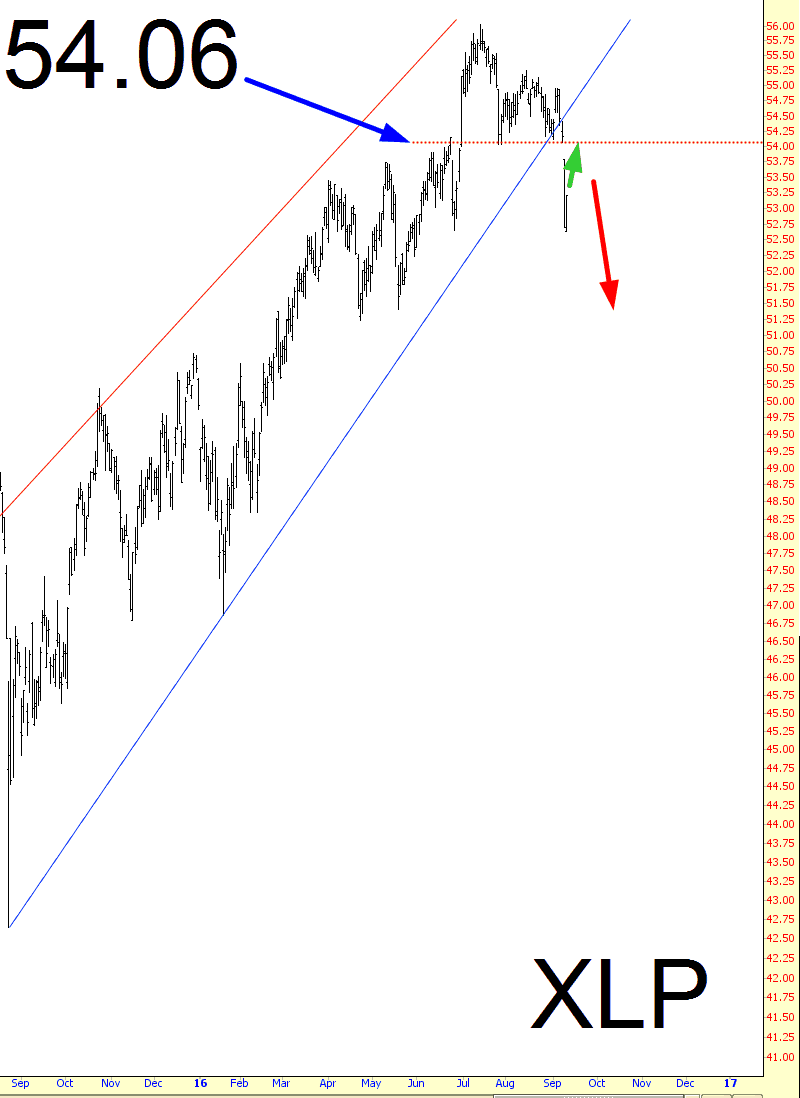

I like ’em both – – the closer they get to the gap, the safer they are as shorts.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Oil Technicals Continue to Look Constructive

Unless and until Oil breaks below the Sep 1 low at $43, my medium-term pattern and momentum work argue that all of the action off of the June high at $51.67 represents a major digestion period within an incomplete recovery period off of the Feb low at $26.05, which projects to $60-$65.

With the foregoing in mind, heavy and important support resides between $45 and $44, which so far has contained the selling pressure off of last Thursday’s (Sep 8) high at $47.75. The longer Oil holds in the $45-$44 area, the more likely my medium-term bullish set-up will begin to unfold in the days ahead — a thrust to new Feb-June highs above $51.67 towards $60-$65.

Originally published on MPTrader.com.

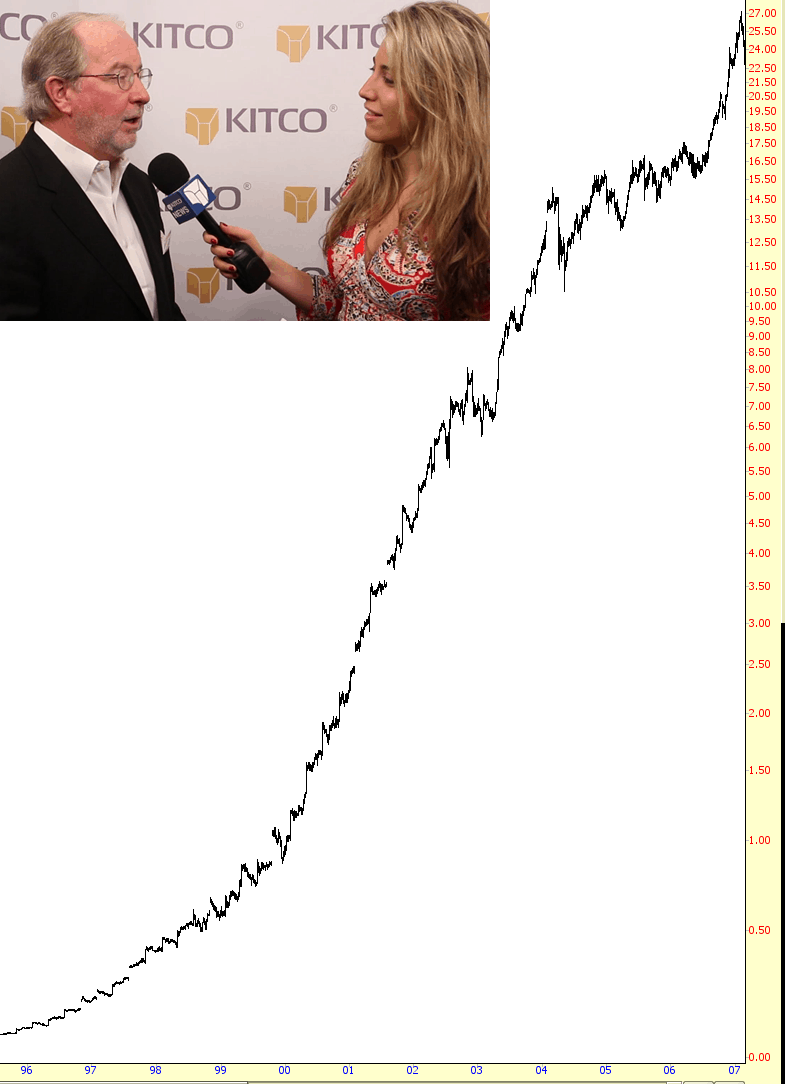

Juniors Forming Top

Well, true to form, Gartman deciding to go bearish has completely wrecked things for the bears (although I guess I should be grateful he was “pleasantly long”, whatever the hell that means, on Friday morning). If there was such a thing as an Inverse Gartman Fund (which is an idea people are constantly touting), it would look like this:

Downside Targets

Well the bears certainly found their car keys on Friday, and I was pleased to see (buffs fingernails modestly) that ES Dec closed exactly on the double top target at 2114.5 that I gave on Friday morning. So what now?

All charts today done for Trader Chart Service at theartofchart.net at the weekend.

Well obviously it seems very likely that this is the 4%+ retracement that I’ve been looking for and historically the absolute minimum target that I’d be looking for on SPX here would be a 3.9% retracement into 2108, with the current low at 2119. The obvious target for this move though remains rising support from the February low, currently in the 2090 area, and I’d be surprised if that wasn’t tested. Short term resistance is the daily lower band, currently at 2143 but dropping of course, and broken support at 2148. SPX daily chart: (more…)