Well, thanks to D.G., the market really screwed the pooch today. However, I think we could be in for a downside surprise tomorrow. Take note of the intraday chart of the Dow Jones Composite. Observe its overhead supply (yellow tint; duh) and the tag of the broken trendline (green circle).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

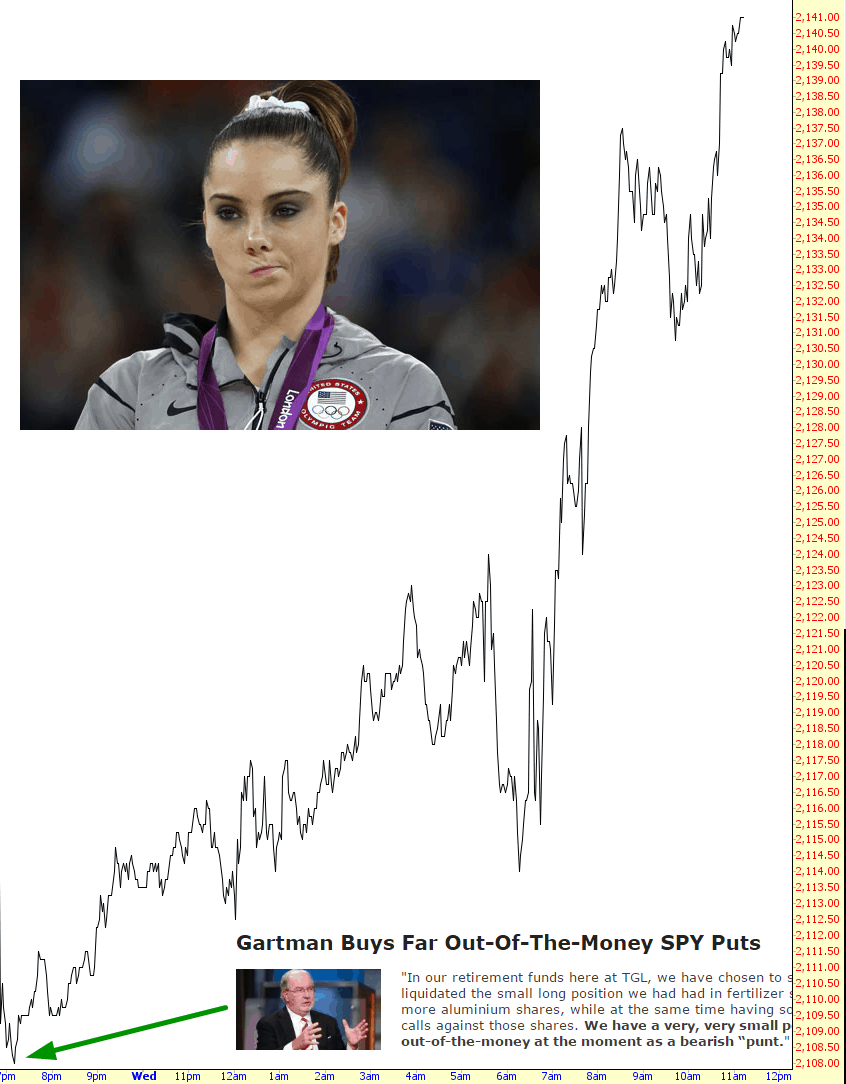

Every. Single. Time.

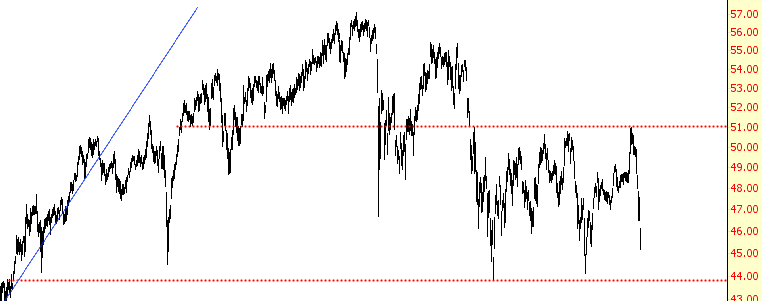

Wells Sinks Lower

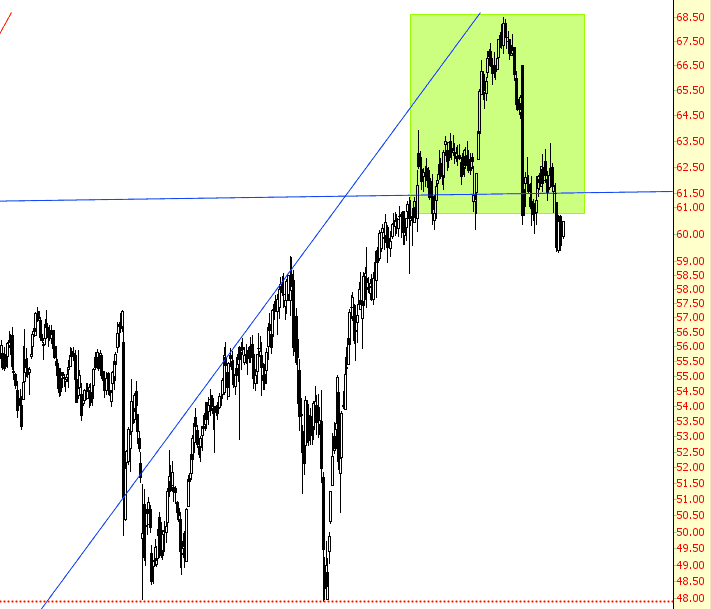

RUT Breaking Up

SPX has now completed for days of a daily lower band ride, and for the last three days SPX has been testing the 100dma at 2121/2, and that’s been looking pretty solid. The two obvious targets below are the minimum 3.9% target below from weekly upper band punch stats at 2108 and rising wedge support in the 2095 area.

Do those targets need to be hit on this move? Well if SPX returned to retest the ATH and only made a marginal new high then this might just be part of the topping process, something which I think is likely in any case, in which case the 2108 target could be hit, and likely exceeded on the next swing down. The current low would also be a (bigger picture) near miss of wedge support on SPX, something seen often before a rally, and then break down through it. It’s possible that this retracement low could be in, though so far I only have 60min buy signals fixed on ES, and brewing on RUT. That’s thin but maybe.

Lamar

Not much happening right now (since the market seems to be struggling with just how to interpret all the economic data that just came in), so I’ll share one particular short I like a lot: Lamar Advertising. Looking closely, you can see the nice little top it has made, and my hope is that we’ll slip ever-lower into the 50s.